Submitted by against_all_odds_ t3_114jf0g in dataisbeautiful

Comments

mr_bojangals t1_j8y9npa wrote

Well R-sqr would be if one was a model of the other. This would just need a correlation coefficient.

Parabola_Cunt t1_j8z78ei wrote

And confidence intervals.

CDay007 t1_j8zpjjh wrote

Confidence intervals for what

Lord_Asmodei t1_j8zpujj wrote

Deviation from mean, obv.

[deleted] t1_j8ypiuk wrote

[deleted]

Then_I_had_a_thought t1_j8z0v20 wrote

In grad school we called it “Chi by Eye”

raff7 t1_j8z4n9t wrote

Loool that’s hilarious.. I genuinely hope this is true and not just a joke ahaha

Then_I_had_a_thought t1_j8zmcv5 wrote

Nope, true story. My advisor got it from his advisor so it’s been around

wonder_bear t1_j8wtt27 wrote

This is the best comment

RockDog2022 t1_j8x2a46 wrote

Completely agree with above. Also though, you would loosely expect to see a 'google' trend of this nature follow any topic of interest. Certainly not a leading indicator.

Grains-Of-Salt t1_j8zi4t9 wrote

This sub is really more of a “data based entertainment” subreddit at this point.

MrTickle t1_j8zmckz wrote

To be fair stats are pretty ugly to most people, wouldn’t really fit the theme to be stat heavy.

charlyboy_98 t1_j8y7wih wrote

Assuming it's a linear relationship

fasnoosh t1_j9adno2 wrote

You’d want to create a scatterplot, with one data point per x value on the line chart, and in the scatterplot, x & y axis represents each trendline color. Then, you could fit that with a model (maybe linear regression), and from that model you could get some metrics out of it, like R squared & confidence intervals

ALandWarInAsia t1_j8xugut wrote

It's not as tightly correlated as the per capita cheese consumption is with the number of people who die by becoming entangled in their own bedsheets. https://www.tylervigen.com/spurious-correlations

Lebowski304 t1_j8zgsg6 wrote

This is very clever and refreshing

mr_bojangals t1_j904cfg wrote

A nice example of why correlation is not cause haha

lebowskisd t1_j906o33 wrote

See, I do agree with you.

But someone told me cheese gives you vivid dreams, and I have begun to notice it myself (granted, anecdotal. Also probably just confirmation bias).

[deleted] t1_j90c0aj wrote

[removed]

MindlessFail t1_j90af96 wrote

Well we found the big cheese plant in the sub

jrm19941994 t1_j914s53 wrote

I'm really confused, why is the average person only eating 1.5 ounces of cheese per day?!?!

ali-n t1_j92pe5r wrote

Because, clearly, you are not doing your share of cheese consumption. Some people don't eat any at all, so you obviously need to bump your consumption way up in order to drive that average upwards.

ilindson t1_j8wnq2k wrote

The correlation is that when people start hearing the price went up or that people are making money with it they do research on it, the same can probably be seen with many different "fads"

[deleted] t1_j91z2lv wrote

Decreases in Bitcoin's value seem to drive more Google searches than increases do.

Skeletorthewise t1_j8wifnx wrote

If bitcoin goes up, people start to searching more info about it.

jamesj t1_j8yn0ap wrote

To really see which effect comes first, a time-lagged cross-correlation plot would be super helpful. Whenever I've done these in the past I've seen the price movement precedes things like tweet activity, google searches, and reddit posts.

[deleted] t1_j8ww6k4 wrote

[removed]

michaelrox5270 t1_j8x1usu wrote

I hope this is satire

Marcusisstic t1_j8x8jar wrote

No. This is Patrick.

oneplusetoipi t1_j8xgfkt wrote

I feel like I have been Rick-rolled

creamonbretonbussy t1_j8z62p0 wrote

Did you reply to the right comment?

michaelrox5270 t1_j8zbt83 wrote

I just really like satire man. I hope this is satire too

Suspicious_Student_6 t1_j8zfww3 wrote

I hope THIS is satire. It's the best

[deleted] t1_j92r02n wrote

[removed]

talks-a-lot t1_j8wlv5p wrote

Quick. Everyone google bitcoin price. We’ll be rich!

BasicWasabi t1_j8wnxhv wrote

This is the way.

PandaMomentum t1_j8x22eo wrote

Scatterplot the two vars and do a Pearson's rho (on day z the price of bitcoin was $x and the search count on Google was y, for each day in T)

against_all_odds_ OP t1_j8x4pwb wrote

Thank you for the suggestion, but the intent was for users to visualize it in relation to actual BTC price.

hxckrt t1_j8yg6uj wrote

Naked caveman eyeballs are not that useful for answering how much they're correlated, and any follow-up questions like which one is leading. Do you know how to do statistical tests? If you do, why are you asking?

Parabola_Cunt t1_j8z7eay wrote

Tried to save this comment but it burned so badly it melted a hole in my pocket protector.

PETNman t1_j8zmagm wrote

Excuse me, but I rarely perform correlative analytics in the nude.

1_km_coke_line t1_j8x8eo0 wrote

Graph the second derivative of the bitcoin price to see the real trend here.

Google search volume spikes whenever the price is actively pumping/dumping.

EDIT: I realize I meant “absolute value of the first time derivative of the price.” instead of “second derivative”.

hxckrt t1_j8yhypi wrote

It's probably a combination of the first and second. The second is true if there are just as many shorts as longs, and it's only people that are checking the price, or other neutral interest. If it's late adopters getting in for the first time, that would be retail going mostly long, and waning interest causing smart money to go short, so that's just the rate of change.

Harrypeeteeee t1_j8xdpwj wrote

Awh yes, correlation = causation

PredictorX1 t1_j8xdknd wrote

I think this would be better visualized as a graph of price vs. searches (or some smooth of searches) rather than both versus time.

canadian_crappler t1_j8x82th wrote

There's a similar chart going back further with a similar eyeball relationship in this academic paper "Blockchain solutions for carbon markets are nearing maturity"

Haleighoumpah t1_j8yb165 wrote

Would be interesting to see a similar chart for Dogecoin, the ultimate memecoin

Kjh007 t1_j8ykmkm wrote

You can likely insert any topic and it’s demand level and they’ll be a correlation.

Ignitus1 t1_j8zvhss wrote

Why didn’t you just do the math and find out? You’re halfway there already.

[deleted] t1_j8wexmf wrote

[removed]

daKoabi t1_j8wo923 wrote

I would say it's the other way around. The more people are interested the higher the value goes. You know media reports all that stuff makes people Google and then buy it. So in that sense they are correlated

Hearing_Deaf t1_j8xqo7h wrote

Somrone's trying to jack up prices to sell

[deleted] t1_j8y7wea wrote

[removed]

Brodie_C t1_j8y7z7v wrote

You should expand this to show 2017 data which was the bull cycle before this one.

mr_bojangals t1_j8y9g2u wrote

Correlation coefficient? Also, I feel any stock that is increasing in value will have more searches. Like, stock price reflects popularity.

TomTheCuban t1_j8yd9um wrote

Anecdotally, spikes in search interest seem to be related to the large changes in the slope of the price. Cool graph, i agree with the r squared guy too

Karnezar t1_j8ye81k wrote

Bitcoin went up when more people bought it, a side effect was googling how to buy it.

Comfortable-Escape t1_j8yh0g6 wrote

Google search is a lagging indicator for BTC price.

[deleted] t1_j8ynq84 wrote

[deleted]

[deleted] t1_j8ypzn2 wrote

[deleted]

[deleted] t1_j8yz5if wrote

[deleted]

sundios t1_j8yzkx3 wrote

Google trends does not get you search volume, it gives you interest of the query. Keyword planner gets you search volume, but it has a 2 month lag.

[deleted] t1_j8z0dqs wrote

[removed]

Weatherman_Phil t1_j8z8ac6 wrote

Yes, when the price goes up, people search it more on Google

Lebowski304 t1_j8zg3zt wrote

There does seem to be a relationship but it is complex

AbuSydney t1_j8zg7yw wrote

Why would you not just divide the two values and see how far away from a horizontal line the metric changes? And how often. Then look at autocorrelation to see if there is a time dependence.

[deleted] t1_j8zkh9k wrote

[removed]

srv50 t1_j8zkjw3 wrote

How fucked is an investment idea where investors make decisions on internet news?

zippadeedooda1 t1_j8zkz0e wrote

Like a sailboat… subject to the changes of the search winds…

CanadianKumlin t1_j8zl5mz wrote

More like the searches are correlated to the price.

thehallmarkcard t1_j8zms69 wrote

This is really only meaningful if the google trends statistics are a leading indicator. Perhaps a Granger Causality test would best express if there is a relationship here.

FUSeekMe69 t1_j8zp9ht wrote

Bitcoins volatility is its publicity

EffectiveBread42 t1_j8zpzlc wrote

We can also see the fomo and the fear as well

Holyskankous t1_j8zxau6 wrote

It is. Except when it isn’t.

50% of the time it works every-time

2nra95 t1_j8zyr8q wrote

I'd like to see if the derivative of the Bitcoin price is correlated with search

WavingToWaves t1_j9000tl wrote

Well, even better, bitcoin price jumps are a cause for search volume, you can predict google search and bet on it!

Btw this is wrong sub for this

crimeo t1_j9284xs wrote

It doesn't help you to invest in something based on news that lags BEHIND the price... you can just look at the actual price and already be way better off. It's also public.

WavingToWaves t1_j9488uh wrote

Yeah, this is what I said 😉

crimeo t1_j949st6 wrote

Oh alright, by bet on it i thought you meant like literally BET on it, as in invest money with hopes of a return, "bet", sorry

[deleted] t1_j903cx8 wrote

[removed]

prof-jimmy t1_j90hvya wrote

H2 2021 was SBf/Alameda peak market manipulation and the only divergence from the general trend

jakubkonecki t1_j90oz0w wrote

Betteridge says 'no'.

https://en.wikipedia.org/wiki/Betteridge%27s_law_of_headlines

AardvarkIllustrious5 t1_j90u0tx wrote

Typical causation vs correlation debate.

[deleted] t1_j90vn8d wrote

[deleted]

jrm19941994 t1_j914nmm wrote

Looks like higher volatility in bitcoin is correlated to increased search interest in near future.

ArvinaDystopia t1_j916g1f wrote

In this thread: people not even looking at the fact that there's no apparent correlation before making regurgitating "correlation is not causation" or "let's all google it!".

I mean, I'm glad people have learned that correlation does not necessarily imply a direct causal link, but can you guys at least look at what you're commenting on?

Lettres-Ouvertes2050 t1_j91jqgg wrote

Price makes the trend. Too greedy people haha

[deleted] t1_j91yok6 wrote

[removed]

crimeo t1_j927xps wrote

Looks pretty obviously to me like searching here shortly follows "big changes either way" just as you'd expect intuitively. Okay and?

Alone-Monk t1_j92kbfb wrote

I think the absolute value of derivative graph of the Bitcoin price might show an interesting story

zeoNoeN t1_j9392t5 wrote

dataisbeautiful-ModTeam t1_j93luut wrote

/u/against_all_odds_, thank you for your contribution. However, your submission was removed for the following reason(s):

- [OC] posts must state the data source(s) and tool(s) used in the first top-level comment on their submission. Please follow the AutoModerator instructions you were sent carefully. Once this is done, message the mods to have your post reinstated.

This post has been removed. For information regarding this and similar issues please see the DataIsBeautiful posting rules.

If you have any questions, please feel free to message the moderators.

[deleted] t1_j96noi4 wrote

[removed]

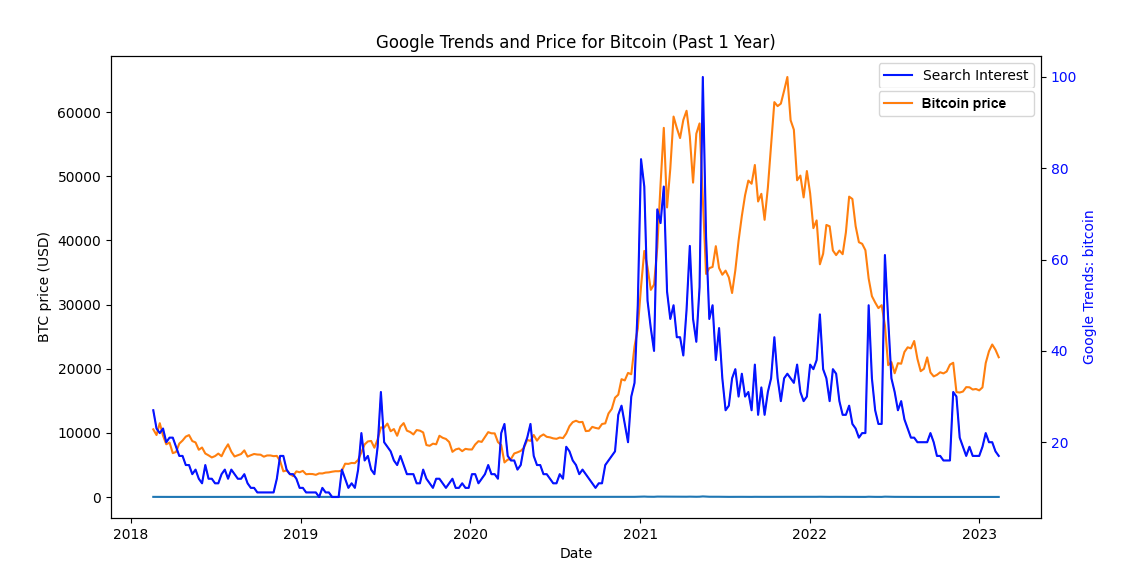

against_all_odds_ OP t1_j972scz wrote

u/dataisbeautiful-ModTeam :

Sources:

- Google Trends, Web search volume for word "Bitcoin" (Period: 2018 - 2023, Location: Worldwide): https://trends.google.com/trends/explore?date=today%205-y&q=bitcoin

- Bitcoin price in USD, Coinmarketcap : https://coinmarketcap.com/currencies/bitcoin

- Software visualization: Python-PK, PyTrends, Matplotlib

I hereby declare, that I have myself created this content using the mentioned tools and by combining the listed data sources together. My contribution is scaling the different sized scales of both variables (search volume and Bitcoin price) to the same common scale, so viewers can compare easily the grown of both functions.

P.S: I will try to post in future an improved version of this post with first and second derivatives of both functions.

against_all_odds_ OP t1_j8wd4cu wrote

FYI: The data for both Bitcoin price and Google search interest has been scaled together to 100%. I forgot the title in the code erroneously stating "(1 year)", but it's "(5 years)" in actuality.

Fartmotherfuck t1_j8zbpv2 wrote

Correlation =\= causation

Enviid t1_j8zucja wrote

Y’all search Bitcoin right now. EVERYONE!!

buwefy t1_j90ooqw wrote

Lol the only correct price for Bitcoin is 0 (although I wish there's enough stupid people out there who keep buying and.pusj the price up, since I'm among them)

[deleted] t1_j8xi735 wrote

[removed]

CommodoreSixty4 t1_j8xijvq wrote

Price Goes Up -> Number of Headlines Goes Up -> Number of Search Results Goes Up -> Number of clicks on said results goes up

pizza_alarm t1_j8zbcuj wrote

This makes me think of the causation = correlation lecture I got in college where the prof mentioned that suicides rise nationally when Nicholas Cage movies premier.

Best lecture ever.

BourboneAFCV t1_j8wf6dz wrote

Bitcoin Follows the US Economy, Whatever happens over there, it will follow, Like interest rates and US GDP

What-Fries-Beneath t1_j8wfjfe wrote

It follows collective psychology. It's a bet based on emotion.

Like interest rates and US GDP, but stupid and based on no actual value

SaintUlvemann t1_j8yz6pi wrote

All the efforts of all the cryptocurrencies in the world haven't yet reached the level of day-to-day practical utility as a McDonald's giftcard; because I can spend the giftcard to buy the hamburger, but there is no store anywhere around me that accepts Bitcoin, or any other cryptocurrency.

LotLizard55 t1_j8z47w5 wrote

Collectible-> store of value -> medium of exchange. Would you rather hold a McDonald’s gift card for the next decade or bitcoin. 99% of crypto is vaporware riding on bitcoins coat tails. I do not disagree majority has 0 utility today

What-Fries-Beneath t1_j8z8b6h wrote

McDonalds gift card for a day which I would exchange for a burger. I might take the money I would otherwise have spent and invest it in some vehicle which offers some degree of oversight/regulation, for example a mutual fund, bond, or currency stake, and the backing of a powerful entity like say a government.

As opposed to "investing" in this week's comp sci program dropout's first live software project based on an ultimately insignificant, artificially and nearly arbitrarily derived slice of an infinite distribution of numbers in geometric space.

The day shitcoins truly have utility is the day they become indistinguishable from "real" money with all the regulations, transparency, and backing of currency, investment, and banking today. Until then they're just a ponzi treadmill

LotLizard55 t1_j8zcgqw wrote

Sir, when you look across the world, do you feel like governments have your best interest at heart? Highest debt/gdp since WW2. Aging demographics and rising interest rates. They are going to inflate the debt away or default there is no alternative. I like bitcoin because it lets me opt out with a portion of my saving in a money that can’t be corrupted by 12 people around a table in Washington. Im going to be paying social security my whole life and I’m lucky if I see a penny from it.

We are very privileged in the west to have bank accounts and access to financial products. A lot of the world does not have that but they do have an internet connection and can access bitcoin.

The beautiful thing is that the market will decide over time. Me and your opinion don’t matter in long run.

What-Fries-Beneath t1_j8zjjj8 wrote

>Sir, when you look across the world, do you feel like governments have your best interest at heart?

To some extent yes. In most democratic governments most of the people are just ordinary folk who rather than building lives around power and influence, they wanted a steady job with decent benefits. They have families which are more important to them than their 9-5. They don't want their friends and families with similarly modest lives to get fucked by the rich and powerful right and left.

Granted many->most politicians are narcissistic douchebags. Nearly ALL aspiring CEOs are narcissistic douchebags. Especially in finance. "My greatest dream is to get rich quick while providing minimal value". That's the sociopathic motto of finance.

>money that can’t be corrupted by 12 people around a table in Washington.

You prefer less people with zero oversight and far less accountability...

>The beautiful thing is that the market will decide over time.

The libertarian religion isn't beautiful to most of us. It has been resoundingly disproven by history. Regulations are written in blood.

LotLizard55 t1_j8yz5f1 wrote

Fixed supply money tied to energy. Peer to peer and can have final settlement in seconds. Must have some value no?

marfaxa t1_j8z2zld wrote

It just must!

LotLizard55 t1_j8z5bjf wrote

Market says it’s worth $25,000. So yes people value it.

SnooPeripherals1914 t1_j8wkh5b wrote

Traditionally you’d express this with an r sq instead of just eye-balling trend lines…