Comments

PM_ME_A_PLANE_TICKET t1_jc37eu5 wrote

Surely my bank won't be on this li- dammit.

phdoofus t1_jc38zwb wrote

Notice the lack of recognizable banks doing normal business.

andycam7 t1_jc3b5xo wrote

Is it possible to scale the dots based on size of total deposits?

Square_Tea4916 OP t1_jc3cpau wrote

Yeah that’s possible. I’d really want to see how much of their deposits are from accounts under $250k vs Commercial.

Square_Tea4916 OP t1_jc3d9g9 wrote

Keep it under $250k, pal :)

zortlord t1_jc3ef6o wrote

FDIC does not keep enough money on hand to fully insure all banks, you know... they really only have about $128b which is < 2% on the entire US banking industry.

Square_Tea4916 OP t1_jc3epls wrote

If it got to that, then you have to add whatever they print out as a bailout “to restore faith in the American banking system.”

tall_ben_wyatt t1_jc3hvua wrote

A lot of these are very recognizable…

rabbiskittles t1_jc3hz2n wrote

“Popular Inc.” sounds like a bank the South Park kids would open after learning that bankers can gamble with other people’s money.

Square_Manufacturer2 t1_jc3jn4g wrote

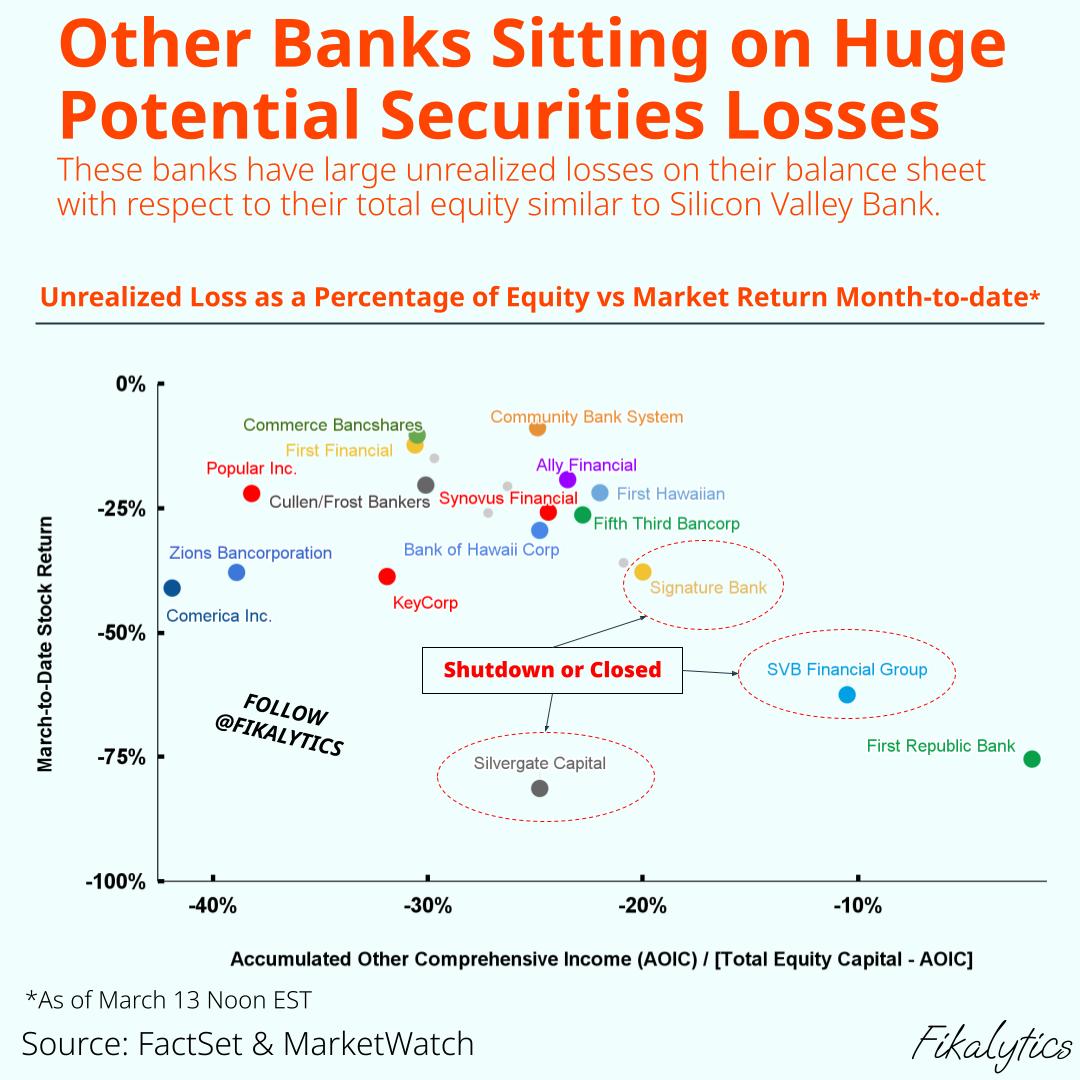

So is the top left quadrant less risky? Guessing based on failures in bottom right quadrant.

CerebralAccountant t1_jc3lec8 wrote

Unfortunately, that says more about your familiarity with large regional banks than anything. At least six of the 50 largest banks in the US are in that diagram (Fifth Third, KeyCorp, Ally, Comerica, Banco Popular, Synovus), plus two more that are top 50 sized but excluded from the list for technical reasons (First Financial, Zion's). All but First Financial are traditional banks that have been around for more than 100 years.

CognitoJones t1_jc3md5f wrote

Stupid question, First Republic- yea or nay?

PM_ME_A_PLANE_TICKET t1_jc3mm11 wrote

gonna be tough, but I'll try! lmao

Less-Dragonfruit-294 t1_jc3mqbd wrote

I don’t see my bank on the list! Wait maybe they’ll be on page 2. Shit.

MadtownV t1_jc3qieo wrote

Good thing money isn’t real

ktxhopem3276 t1_jc40zu4 wrote

Does this only take into account assets for sale? Fifth third ceo said on cnbc today his bank holds all securities as available for sale. So does this chart penalize this banks while obscuring banks shifting securities to assets held to maturity?

ktxhopem3276 t1_jc428pb wrote

Deposits not insured by the FDIC

Signature Bank 90%

SVB 88%

Citigroup 85%

First Republic 68%

JPMorgan 59%

BNY Mellon 56%

Citizens Financial 49%

KeyCorp 47%

PNC 46%

Truist 46%

M&T Bank 45%

Fifth Third 42%

Bank of America 33%

Goldman Sachs 33%

Huntington Bancshares 33%

paleblued00t t1_jc4aoef wrote

Looks like KeyCorp is going down

putalotoftussinonit t1_jc4ddow wrote

Hope they enjoy all of my debt.

rynoxmj t1_jc4dt4k wrote

Sooo... First Republic is next you say?

Deepfriedwithcheese t1_jc4lb7x wrote

Loving my credit unions right about now.

Infinite_Carpenter t1_jc4v1gi wrote

Thank god the republicans got rid of Dodd-Frank (which was toothless anyway).

DD_equals_doodoo t1_jc4yv26 wrote

The y-axis is kinda useless for inference because of endogeneity.

Dick_Cottonfan t1_jc507v5 wrote

OH MY GOD, YOU SHORT-SOLD KENNY!!!

Acrobatic-Event2721 t1_jc52fwy wrote

They’ll sell bank assets before they use their cash reserves.

[deleted] t1_jc576m5 wrote

[deleted]

NewDeviceNewUsername t1_jc5i2dg wrote

They zero out mortgages right?

zonazombie51 t1_jc61ase wrote

This has just been copied over from r/StartARunForFun.

aussie_punmaster t1_jc61z21 wrote

Fifth Third Bancorp?

I’d shut it down just for having a stupid name.

shinshit t1_jc65tlw wrote

Yup. They're struggling to even keep 1.35% in reserves.

Wizard01475 t1_jc6iqyi wrote

Let them all fail. No Bailouts!

Square_Tea4916 OP t1_jc6r49v wrote

Let’s unpack this.

It’s not fear mongering, it’s information sharing. I can’t help if someone is fearful based on their perception of information. Sure there could always be more context, but that’s subjective.

No where did I mention or imply “hidden” losses in this chart. Nor did I equate unrealized to hidden losses. Again, this is your bias making an assumption the chart or article never mentioned. It’s simply showing exactly what you mentioned in the first few paragraphs regarding their HTM securities were not meant to be sold, but now they have an increasing gap in their securities valuation and have an increasingly larger unrealized loss position. This issue plus how the bank responds to handling their situation is what spooks investors and in turn depositors.

Khyron_2500 t1_jc6zwc9 wrote

“You had some money—aaaand it’s gone.”

[deleted] t1_jc7unb7 wrote

[deleted]

Square_Tea4916 OP t1_jc34xi7 wrote

Source: https://www.marketwatch.com/story/20-banks-that-are-sitting-on-huge-potential-securities-lossesas-was-svb-c4bbcafa

Tool: Google Charts