Submitted by giteam t3_y30snm in dataisbeautiful

Comments

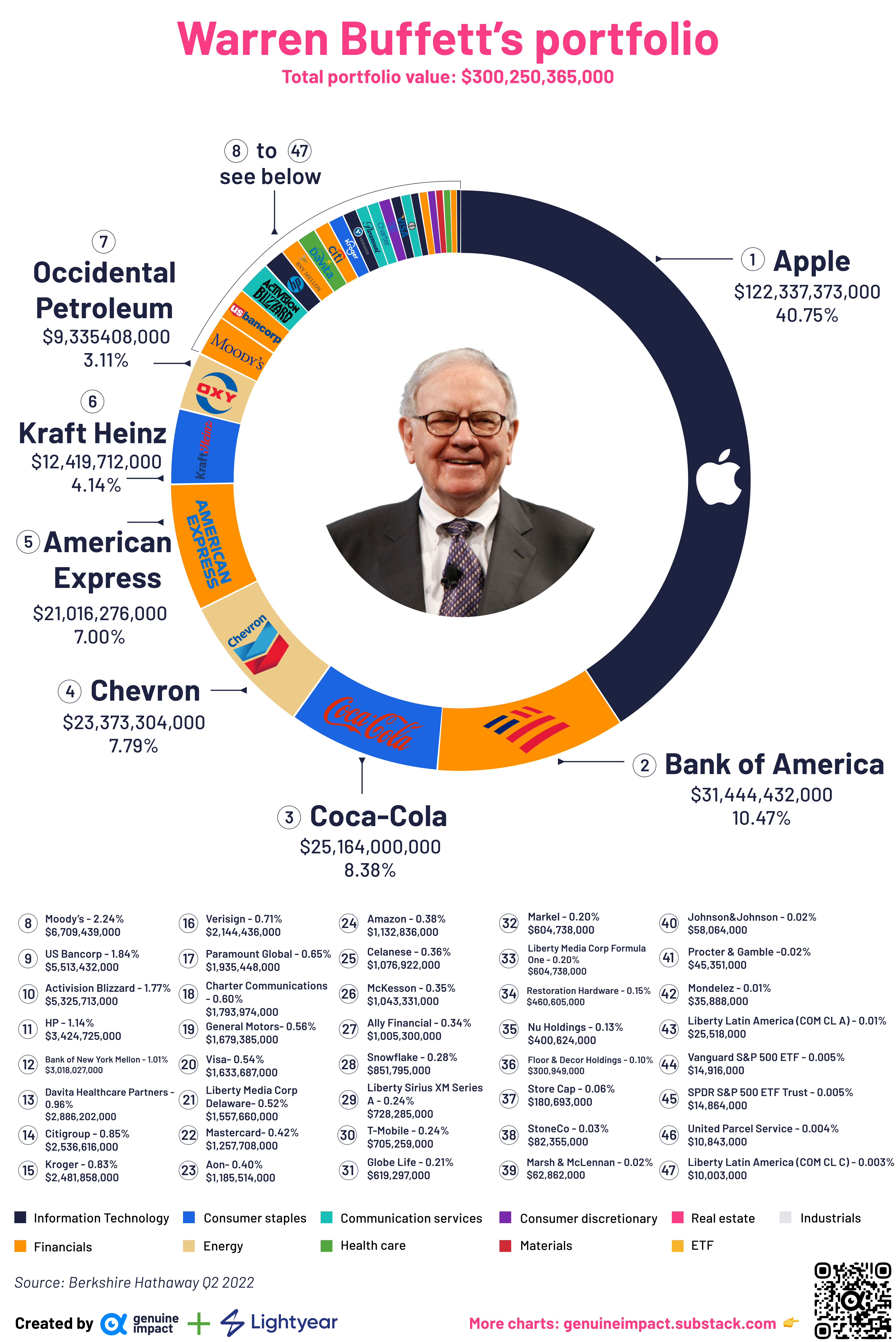

Middle-Ad-9181 t1_is609yf wrote

Was thinking the same thing. About a third of BRK is owned by him yet in this graph his ownership in BRK is zero.

40for60 t1_is79h5t wrote

This is a graph of what BH owns not who owns BH. The title of the graph is wrong its not WB portfolio but BH portfolio.

FizzleShove t1_is7lqwz wrote

Was thinking the same thing. About a third of BRK is owned by him yet in this graph his ownership in BRK is zero.

omicron_pi t1_is8ccqv wrote

Why are you copy pasting the (incorrect) comment above? Some redditors are bizarre

5l4 t1_is8jtt2 wrote

Was thinking the same thing. About a third of BRK is owned by him yet in this graph his ownership in BRK is zero.

FizzleShove t1_is8iucb wrote

I am more bizarre

[deleted] t1_is97g0f wrote

[deleted]

monaroadams11 t1_is97hqy wrote

This is a graph of what BH owns not who owns BH. The title of the graph is wrong its not WB portfolio but BH portfolio.

RadioStalingrad t1_is766yz wrote

These are the stock holdings in the BRK portfolio. They also own many other businesses outright that aren’t traded.

blurubi04 t1_is89ptc wrote

I was just about to say ah where’s his railroad??? Data would be more beautiful with the privately held tossed in.

giteam OP t1_is61e71 wrote

Yes you are right

LakeSun t1_is7akav wrote

Old man, still in oil.

"FU World, I want the money."

thesweeterpeter t1_is5xb7j wrote

What I love about his investing is that there's no big games. No short positions (at least that I can see) or shit like that.

He's into fundamentals of if a company will be profitable.

And then holds for an eternity.

There's got to be a lesson in that.

big-big-boy t1_is7qfdn wrote

yeah the lesson is be a billionaire and you don’t need to take risks

Eriknay t1_is82zar wrote

Except for Apple, where someone made the decision for him and it massively drove Berkshire returns for a decade plus.

Heavy_Following_1114 t1_is6y96l wrote

It's an old school method of thinking. Tried and true

[deleted] t1_is6rqrk wrote

[removed]

Americangrit t1_is9090y wrote

I guess you don't have to short when you made your billions gutting companies that were upside down.

b1ue_jellybean t1_isa2rvp wrote

I mean sure if you’ve got decent starting capital and don’t mind getting not much returns for a long time.

Mobely t1_isam9ll wrote

That's his advice to the common man. He is active in company decision making and partners with Bain Capital on some major deals.

LooseEarDrums t1_is7z307 wrote

He likes to invest in companies with market power. Which are bad for the economy.

buzzzzz1 t1_is6kucn wrote

No big names? Apple is the most valuable company in the world.

deadflashlights t1_is6kzt7 wrote

Big games you misread

buzzzzz1 t1_is6lxpv wrote

Ah, that makes more sense.

[deleted] t1_is6l02y wrote

[removed]

firstcoastyakker t1_is6231u wrote

Good for me, I own some of those!

Bad for me, my "portfolio" is about 1/10,000,000th of his.

Hungry-for-Apples789 t1_is77i4g wrote

But between The two of you you have over $300b

firstcoastyakker t1_is78lcl wrote

That's a great way to put it! I feel better now about buying some Ben & Jerry's.

wtfthoplshelp t1_is7imbo wrote

I guess he’s doing alright.

jaypizzl t1_is8mxz2 wrote

He is, though this chart is off by an enormous amount.

giteam OP t1_is5udsh wrote

Xnbuilt t1_is70nfq wrote

https://www.visualcapitalist.com/cp/berkshire-hathaway-holdings-since-1994/ Or watch BRK holdings over time here!

Less-Dragonfruit-294 t1_is7s5j0 wrote

Let me just pull out a couple of millions out my ass real quick to match this man’s portfolio. Y’all accept shitcoin?

porcelainvacation t1_is8fk6y wrote

Just buy BRK/B (or A for that matter, if you can)

Siggi_pop t1_is8xtku wrote

And he calls himself diversified.

PleadingOwl t1_is7p0pl wrote

Why bother with the 0.005% in the S&P500?

cashmcnash t1_is965vz wrote

Park extra cash in the index and let it accumulate until he finds another deal

Keep in mind he’s getting dividends and they need to go somewhere until he finds a buying opportunity

tunawithoutcrust t1_is85rsh wrote

Didn't realize his holdings in JNJ and PG was so low...

CRnaes t1_is9hfok wrote

I might have to look into this 'Apple' 🤔

Heroic_Self t1_is9tvpk wrote

It looks like BH buys brands more than companies

ggrandeurr t1_isaih1f wrote

He’s been doing this since the 1950s, some of these didn’t become brands until later.

Also, he’s buy big name brands when they were cheap. For example, coca cola stock tanked in the 1980s when new coke was introduced, Buffet gobbled up as much coca cola stock at the time while it was cheap, then everyone forgot about new coke and the stock recovered and Buffet walked away with big time $$$

[deleted] t1_is6l4bn wrote

[removed]

[deleted] t1_is7m5jj wrote

[removed]

passed_turing_test t1_is7wdnr wrote

Still bullish on tech eh? Hmmm

Andress1 t1_is9q94y wrote

He has an incredible amount of money, but he's 92 years old already.

He's gonna die soon unless some treatments for aging get developed fast.

That's his only chance, I wonder why isn't he investing his money in that, he will lose everything he worked for soon...

[deleted] t1_is9r4fe wrote

[removed]

MyFriendMaryJ t1_is9wx3a wrote

.003% of it is still 10x more money than most people see in their entire lives. This amount of financial manipulation consolidates wealth further making it even harder for the working class.

ggrandeurr t1_isajkiy wrote

This doesn’t include the $100-140 billion that BRK is currently holding in cash, which would put it at #1 or #2 spot on the portfolio.

hbonnavaud t1_isan7lg wrote

If his bank is the bank of america, and the 'bank of america' action lost value, so he's more poor, so his bank have less money, so it's value fall down more :O

moonkingdome t1_isc4tlz wrote

Nice Berkshire portfolio graph

AstonGlobNerd t1_ischh6p wrote

Why both vanguard and spdr index funds?

[deleted] t1_isgo24z wrote

[deleted]

kUbogsi t1_is7oa3n wrote

Wirh inflation so high they need to make over $30b next year to not lose money

ThetaGreekGeek t1_is8h5fl wrote

Imagine being able to sell high percentage out of the money call options on those Apple shares every week. Unreal.

aPizzaBagel t1_is8hf4o wrote

Sell the oil while you can, old man

Upstairs_Profile_355 t1_is7qnza wrote

Nobody should have 40% of AAPL for their portfolios.

AnarchyNotChaos t1_is7oo9c wrote

Can't wait until he.... well, y'know ;) 💀

Rear-gunner t1_is5xmes wrote

Nancy Pelosi sharemarket figures are much better than his.

blargh9001 t1_is7a7sa wrote

At least 10% in fossil fuels, not a good look.

zxcvbmm t1_is7s81z wrote

Honestly the most immoral holding is Coke

firewaterstone t1_is6khxl wrote

Beautiful dataset of a parasite whose often put on a pedastal.

kylel999 t1_is6l1qq wrote

oH bUt HeS fRuGaL!

Maximus15637 t1_is73me2 wrote

No wonder he’s rich, the dude owns 40% of apple!

XTremeEd t1_is7alvw wrote

40% of his holdings are apple. He owns about 5%.

itswill95 t1_is5xtvt wrote

isnt this the portfolio of berkshire, not warren buffets personal stock holdings