Comments

Karl_Pilkingt0n t1_j0qtdk2 wrote

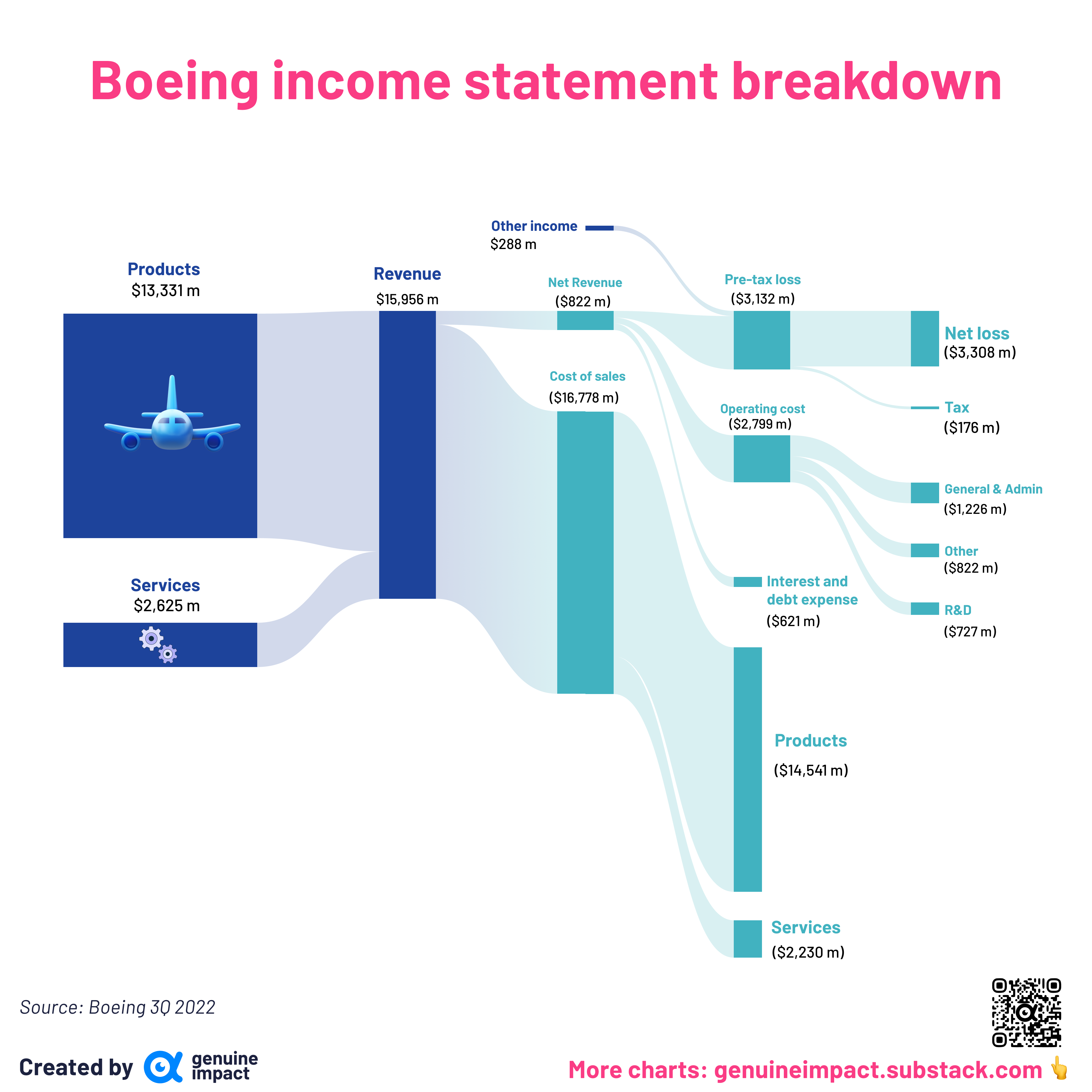

Thanks for the Sankey link, I've was wondering how people made these charts.

Karl_Pilkingt0n t1_j0qtz4h wrote

It maybe useful to note that these numbers are for a single quarter?

Usually if you don't call the duration out, the default assumption would be annual revenue.

Gabagool1987 t1_j0qxk34 wrote

Still their future doesn't look good with Airbus gradually pushing them out of business. Go back 40 years ago, and literally the only choice for major airliners was Boeing or lackluster Soviet models used by third world countries. Now you have Airbus making similar if not superior products.

Tato7069 t1_j0qxve7 wrote

It says it on the chart...

Edit: not sure why I'm being downvoted, it literally says "3Q 2022"... If you don't know what that means, the rest of the chart probably doesn't mean anything to you

The_SAK_Fanboy t1_j0qyz37 wrote

Would have thought Lockheed Martin would be the biggest company given its near monopoly of the US defence budget

ar243 t1_j0r07mk wrote

It's weird that companies pay taxes after operating expenses, but regular people pay taxes as soon as they get their paycheck. Seems a little unfair.

Why not just make companies pay taxes on their total income? Is it to incentivize spending on stuff like R&D? Maybe someone can explain this to me

secoccular t1_j0r8gjo wrote

If you're talking market cap, LMT is larger of the two (not by a large amount). In terms of revenue, Lockheed is larger. In terms of net income, it's no contest.

Both are in Aerospace & Defense, so your point seems valid.

bobbyorlando t1_j0rll37 wrote

And what are the numbers for like Airbus? You stated it's the largest, but you provided no comparison....

DrTonyTiger t1_j0rnn3t wrote

Sankey charts become difficult to interpret when there are both positive and negative values. Is there a better way to present the gains and losses?

spros t1_j0s93u6 wrote

Regular people can choose not to pay taxes until tax day.

pricktive t1_j0secu5 wrote

You can write off all business expenses in your taxes; the government pays for your business expenses, including frivolous bullshit like luxury dinners. It is only pure profit that's taxed. The individual is taxed as soon as they get any money, even if the paying that tax means they don't eat that week.

dtjyroarijiorbnbqa t1_j0sucgx wrote

airbus flopped in the wide body and military markets

askLubich t1_j0tlbk2 wrote

Airbus is larger by almost every metric: https://www.aviacionline.com/2022/01/airbus-overtakes-boeing-and-is-the-largest-commercial-aircraft-manufacturer-for-the-third-year-in-a-row/.

itskai_y t1_j0tntsp wrote

That is for commercial aircraft. Both companies sell more than just that. They are of very similar size, but I believe Boeing just edges them out in total revenue.

Obvious_Chapter2082 t1_j0udskq wrote

It’s mainly because businesses need high expenses to operate. If you were to tax total income, you’d have to do it at a very low rate so that businesses don’t go bankrupt

But even still, Boeing is paying tax on a loss here. So they have no income, but still owe tax

Ya1233 t1_j0ywycf wrote

I mean they could put that in the title is everyone’s point. If you have to fish for it, the viz already failed.

Someone could scroll by this and come to the conclusion that Boeing is a 12B USD company, which is incorrect it’s a 60B+ company.

Obvious_Chapter2082 t1_j0yx3sk wrote

Frivolous expenses aren’t usually tax-deductible. And the government doesn’t pay for it, it just means that the company reduces their taxable income by that amount

Tato7069 t1_j0zcfsu wrote

How? It doest say that in the title either. Yeah, I mean I guess if someone doesn't attempt to comprehend something, they may not comprehend it...

Dildo_Swaggins_8D t1_j173qsh wrote

How much of that revenue comes from military-related contracts?

giteam OP t1_j0qt0ok wrote

Source:

Boeing

Genuine Impact chart newsletter

Tools:

Figma Sankey