Submitted by fred_fotch t3_zvaijm in dataisbeautiful

Comments

iluvios t1_j1oh95x wrote

Well, there is a reason the price has not increased... They are incompetent.

inconvenientnews t1_j1oia02 wrote

Their incompetency in policies even affects life expectancy:

>with an average life expectancy of about 74.6 years, which would put it 93rd in the world, right between Lithuania and Mauritius, and behind Honduras, Morocco, Tunisia and Vietnam. Mississippi, Oklahoma and South Carolina rank only slightly better.

LavaWorldstar t1_j1pjq01 wrote

The above snippet is referring to West Virginia, not Mississippi (for anoyone else that was confused)

BandsAndCommas t1_j1qxir1 wrote

you compared the poorest part of America to entire countries with their own economies 🤦🏽 now compare Mississippi to the poorest part of Vietnam/Morocco/Honduras

BobRussRelick t1_j1p0eb4 wrote

and there's a reason DC price increased the most

Roy4Pris t1_j1p523l wrote

Lobbyists and defence contractors

CharonsLittleHelper t1_j1q53vi wrote

Plus in the 70s DC was a scary place to live. So very low baseline.

Caimthehero t1_j1r33mv wrote

Yeah trying to price out most of the black people has it's costs, tell that to politicians and they say shit like "we need more affordable housing" and whisper "but not where I live"

BobRussRelick t1_j1r5bbt wrote

sure, people want to pay hundreds of thousands of dollars extra on their mortgage to pawn the blacks

[deleted] t1_j1pqq88 wrote

[deleted]

Section_Hiker t1_j1pwkab wrote

Then DC would be at the bottom of the list..

[deleted] t1_j1sjhob wrote

[deleted]

ehmiu t1_j1ph0gv wrote

Almost every one of the states at the bottoms of ranking lists has one ironic similarity. And when people who represent that similarity ever bring up "secession" or "civil war," I think about how they are justifying why they are at the bottoms of so many of these lists.

[deleted] t1_j1pj1r6 wrote

[deleted]

Matt_Candlewood t1_j1ogzf0 wrote

Y axis labeling is mildly infuriating

fred_fotch OP t1_j1ohd57 wrote

Yes, you are right haha. I should have started at 0% and gone up by 400% or 500%.

lolheyaj t1_j1p6kn9 wrote

So is the X labeling just rotate the whole thing 90 degrees at that rate and make the image a little taller instead of wide. Everyone is turning their head or their phone anyway.

godspareme t1_j1qvd01 wrote

Putting the labels at a 45 degree angle would be a little bit better, too.

[deleted] t1_j1pdkyj wrote

[removed]

skunkachunks t1_j1ofqjd wrote

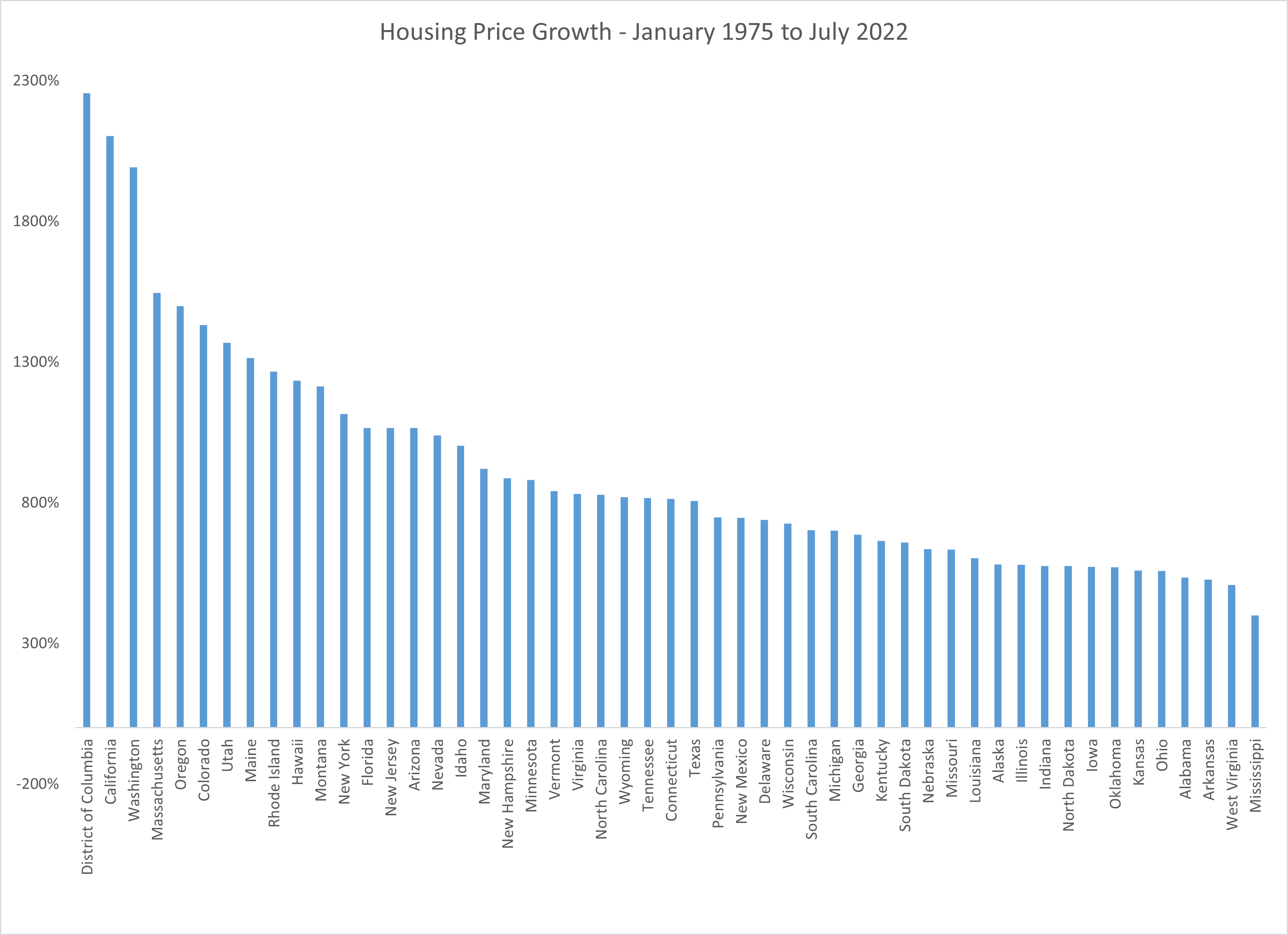

The cumulative rate of inflation since 1975 is about 450%. So most states’ housing costs have increased more than inflation (assuming square footage has remained constant….which it probably has not)

fred_fotch OP t1_j1ohkdr wrote

The median state is Connecticut at 814%. The simple average is 918%. I am not sure what the weighted average is, but I guess it's over 1000% because of California and New York.

Anachronism-- t1_j1pmp61 wrote

I find slightly different numbers from different sources but they are all pretty close to around 1600 square feet in 1970 to 2600 square feet in 2016(last year listed).

The number of houses with two or more bathrooms has gone from 30% to 80%.

https://www.aceee.org/files/proceedings/2004/data/papers/SS04_Panel1_Paper17.pdf

Ambitious-Event-5911 t1_j1oscbl wrote

This is why I'm renting. I hate real estate speculators. I hate that our country allows housing to be used as an investment. I hate Jamie Diamond the predatory lender that still got all his bonuses.

scarabic t1_j1r8hvq wrote

How is renting a solution though? Rents are skyrocketing everywhere as well. Who do you think is bringing cash to this table and pouring it into speculators’ pockets? Renters.

iidesune t1_j1wt8rb wrote

Homebuyers are pouring money into the real estate market as well. A house is only as valuable as what the next buyer is willing to spend on it. Hence the delicate balance policymakers must manage when it comes to housing affordability. Homeowners want to see returns on their "investments," but can only do so if a prospective homebuyer pays that return. It's a rat race.

At least with renting you can always vote with your feet or seek better employment in a new zip code or state. Paying rent isn't throwing away money at all. You're paying for the freedom and convenience to move around and find a situation that works best for your current situation.

scarabic t1_j1wyw9b wrote

The difference is you can buy houses on credit, leverage. In a hot market, borrowing is cheap and speculation drives speculation. Rent, meanwhile, is always paid in cash. Rent is the transfusion of actual blood into what is otherwise a zombie of speculation and credit. It props up the rat race. And renters are getting squeezed hard as the balloon grows.

Sure renting has advantages. Easier to move. Predictable costs. But now we’re on a different subject. We started on rent being some kind of way out of the housing market shit show, and unfortunately it totally isn’t.

Sure, you’re paying rent for something but your rent is often paying the entire mortgage of someone else who is just sitting back gaining equity. It’s hard to say you’re throwing money away but impossible to say you’re winning or not part of the game.

iidesune t1_j1x1776 wrote

> Rent is the transfusion of actual blood into what is otherwise a zombie of speculation and credit.

I actually have no idea what you mean by this

scarabic t1_j1xgalo wrote

Yeah maybe that metaphor is pretty obtuse.

What I mean is that speculation bubbles don’t always have much basis in real value. Housing in particular is highly leveraged. People buy a house without having all the money for it. Banks lend them the money but they’re not entirely liquid either. The mortgage gets sold and resold, bundled into investment vehicles and derivatives. Families count on their house to be some kind of “investment” and rely on the bubble to fund their retirement. It’s a big network of over-leveraged actors. It stumbles onward largely on its own momentum, but it can be totally hollow, a bubble, a “zombie.”

Renters on the other hand pay cash in hand everywhere they go. Nothing they do is permitted to be a loan or leverage. Whenever renters appear in the diagram, actual cash is flowing in. “Blood infusion.”

Maybe I meant vampire, not zombie.

To offer an example: I bought my first home in 2006, right before the big crash. I got a loan with very little down during the subprime lending spree. Then the crash happened and I wound up upside down on the mortgage. Shortly after I also needed that freedom to “vote with my feet” and move that you speak of. Know what I did? I rented the place out. I paid the mortgage, taxes, and repairs with the rent cash while the market recovered. Even pocketed some monthly profit. And once the market roared back, I sold the place at a big profit.

I was the person over-leveraged, actually at negative value, the zombie, but by feeding on renters, I was eventually made whole.

So when you say you rent because you l’re disgusted by the whole speculation market, I don’t see how that’s a solution. The buyers/sellers are still feeding on you as a renter. You’re maybe the only party in the entire picture who is always there with ready cash in hand, while everyone else is engaged in a gang-bang of credit leverage.

iidesune t1_j1xh0vz wrote

This is a fine argument for the merit of being a renter.

Just feel fortunate that you lucked out and found a buyer for your home. I would challenge you to factor in down payment, closing costs, maintenance, interest, selling costs, taxes, insurance, and other housing related costs (furniture, utilities, etc) before determining that you actually made a big profit by selling your home.

scarabic t1_j1xjq9u wrote

Um. My dude. No, I didn’t just forget about my down payment (which immediately becomes equity anyway - you knew that, right?).

The rest of this we tracked continuously and at tax time. If you’ve never owned, maybe it seems hopelessly complex and expensive to you. I can’t tell if that’s it or you just tried so hard to puff up that list that it became ridiculous. Furniture!

Anyway keep renting since you find it morally superior to be exploited than exploit. I won’t take that away from you, just the illusion that you’re somehow not involved.

imnotsoho t1_j1p26wd wrote

What other things would you like to put price controls on? If I buy a car should I have to sell it for the same price? A stock? Painting?

uhh_khakis t1_j1p2qx5 wrote

whataboutism. cars, and certainly not paintings, are not even comparable to the level of requirement for basic human needs and security as housing. show some fucking compassion for people who don't have it as good as you, jfc

daedalus_was_right t1_j1p4h6l wrote

I don't need a painting to live. I don't need stocks to survive.

I need a home as a basic necessity for survival.

Honest question; do you prefer a full leather upper, or something synthetic, when you do your bootlicking?

beerbaconblowjob t1_j1p8oi9 wrote

Well you need food to live, clothes to live, medicine to live, electricity and gas to live. How many things is the government supposed to provide?

Housing gets a bad wrap, but the truth is every industry I mentioned would stop functioning if it weren’t for investors.

YangYin-li t1_j1pq9lg wrote

I like the idea of “everything required to survive”

beerbaconblowjob t1_j1qskop wrote

Ok, just keep in mind that the government will make a much worse fashion designer, a much worse cook, and there will be a two year wait for a crappy roach invested place to live.

YangYin-li t1_j1qtvh4 wrote

That’s a lot of assumptions about how it would work (I 100% get where you’re coming from/saying tho)

beerbaconblowjob t1_j1qxnho wrote

I’d call it a presumption, here’s a government that told us N95 masks weren’t effective at preventing infection, so they could save them from the healthcare workers. A huge lie.

This government that sent out two measly covid tests 3 months after the first Omicron surge. They had an entire year and scientists to tell them to ramp up production because the virus would mutate.

Literally everything they’ve done has been pathetic, so yeah I’m not optimistic about them controlling every aspect of the economy.

Almost everyone wants the poor to be better off, but communism has never worked, and when you point that out to people their response is, yeah but it’d work in utopia.

Sure, but in the real word that much power leads to tyranny, and no organization (government) can do everything right. Corporations need to stay in their area of expertise.

Not sure why people want a massive bureaucracy in the middle of every aspect of their lives.

YangYin-li t1_j1r2iq8 wrote

I just want free food housing healthcare for everyone, and I know we have the means to do it

godspareme t1_j1qvtea wrote

Or, hear me out. Give everyone $1000 (which should scale with inflation & COL) and say "this should cover part of your rent, food, clothes, etc."

No one is asking the government to start their own free clothing production company.

As for a waiting list, not really. There are other countries where housing units are required to be non-profit and rented at cost. They also have a ~30% market share of private housing units that are for-profit. The non-profit drives the cost of for-profit housing units to be competitive and barely above cost. There are little to no waiting lists. And no the places aren't shitty.

That last argument is just fear.

OrderOfMagnitude t1_j1rojxc wrote

Scalping houses is only an investment in the sense that you spend now and profit later. It's not actually doing anything productive.

Investing in businesses, although riskier, has the benefit of growing the economy and helping everyone.

In Japan, where quantitative easing was invented, there were strict investment rules to make sure that investors were investing in real investments and not just the real estate speculation that fucked up their economy. Such rules haven't existed here which is why most free covid money got "invested" in houses, causing rampant speculation.

"I'm just investing" haha go invest in a real business or call yourself what you are: a scalper and a parasite.

jsm1095 t1_j1qlid4 wrote

Can I invest in your ego? Seems like it’ll only go up from here.

tails99 t1_j1pcl5f wrote

The price controls are made by existing homeowners through restrictive zoning. There is no reason why housing should go up in price. Everything is supposed to go down in price, EXCEPT income. Anything going up in price in a free market is an economic aberration. An even simpler solution to cut housing costs is to legalize living in cars, but homeowners and landlords don't like that either, now do they? More of your "price controls"...

kaizerdouken t1_j1pzpzn wrote

Have you ever taken a course in economy? Just curious.

tails99 t1_j1r3728 wrote

I have a degree in economics. Nearly all economists agree that price controls are bad. Rent control is one of those bad things. Exclusionary zoning is the same terrible rent control, except for rich people. I still don't know why it is legal. How can more housing be bad?

Ambitious-Event-5911 t1_j1s1krz wrote

Homes should not be a product. There shouldn't be a market for them.

tails99 t1_j1smsrf wrote

There is market for everything because otherwise no one would know how much to make or at what price to sell. Increasing house prices mean that more needs to be built to then lower prices. If more housing is illegal, then enough housing won't be built, existing houses will go up in prices, and those who can't afford them will live in cars or on the street.

kaizerdouken t1_j1t9qxm wrote

Okay. Maybe I don’t understand what you’re saying. Excuse my ignorance. Let’s say I buy a multi family building. I raise its value and intend to sell it after 2 years. Are you saying this property should not raise its price? Rendering me a loss or no gain by the time I want to sell and make a good gain on it?

tails99 t1_j1tce1n wrote

I'm not sure how your comment is relevant. In your example, there has been no creation of any more units of housing. I'm referring to it being ILLEGAL to build MORE housing that is DENSE.

​

"I raise its value" :: How do you raise its value?

kaizerdouken t1_j1te873 wrote

You’re the one with the degree in economics. I can’t answer for you.

tails99 t1_j1xoqr4 wrote

I can't answer your question because it doesn't make any sense. It has nothing to do with me. LOL.

dontich t1_j1pfasz wrote

I mean there is only a certain amount of in demand land in locations people want to live— even if you allow unlimited density the most popular land would still increase in value…. But yes the actual housing built on said land should depreciate.

tails99 t1_j1r3jja wrote

Yes, exactly. People don't live on limited LAND, people live in HOUSING. Land is limited vertically, like a rare physical Picasso painting, but housing is unlimited vertically, just like looking at a digital Picasso is unlimited.

fred_fotch OP t1_j1o2726 wrote

Made using excel from the FHFA House Price Index https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index.aspx

kaizerdouken t1_j1pzvmt wrote

Glad you put the source. 👍🏽

Veszerin t1_j1ouvyh wrote

And you thought you'd compare a city (Washington D.C) to entire states? No adjustment to control for inflation?

fred_fotch OP t1_j1ovuhf wrote

The whole point is to show the nominal price increase. The original data set had the 50 states and Washington DC.

PapaChoff t1_j1owbwq wrote

Washington surprised me until I looked at how many cooperate HQs are based there.

ShinjukuAce t1_j1qbv8y wrote

Seattle has really boomed over that time, it was a minor city in 1975 and is now a major tech center.

CarpetbaggerForPeace t1_j1pvsed wrote

One thing to consider is that the mortgage interest rate was 9% in 1975. So $100k in 2022 dollars then is equivalent to $150k now at 5% for a 30 year loan. Or $190k at 3%.

fred_fotch OP t1_j1qe7ws wrote

Very true - I thought about doing that, but there were too many other factors to consider (property taxes and insurance costs for example).

tothehops t1_j1o4oqh wrote

Interesting and surprising to see Maine so high

BigBobby2016 t1_j1o97ot wrote

I think it’s just MA rubbing off on the area, not to mention how many massholes go there after they retire

fred_fotch OP t1_j1ot5wn wrote

I thought it was more to do with recreational homes (similar to what I assume is happening in Montana) but I don't know the area well.

[deleted] t1_j1oy1q5 wrote

[deleted]

dawidowmaka t1_j1p2scr wrote

This was super informative, thanks.

I had to look up a couple of places for reference as someone who isn't from Maine, specifically MDI.

[deleted] t1_j1p48oz wrote

[deleted]

BigBobby2016 t1_j1ovwvo wrote

It could be that as well

PapaChoff t1_j1ovzv7 wrote

That and the Portland area

Lar1ssaa t1_j1oac11 wrote

Well that’s sad! Arkansas is such a beautiful place. Guess it’s good that people didn’t discover that yet

Arkyguy13 t1_j1p38xq wrote

In my part of Arkansas house prices have doubled since I graduated college in 2018

Roy4Pris t1_j1p4w7g wrote

There must be some kind of rule, where any graph, featuring US states, no matter what the criteria, will feature California at one end, and Arkansas at the other

Zigxy t1_j1rkwoj wrote

Applies to politics, diversity, lifespan, quality of Mexican food, population health, income…etc

Roy4Pris t1_j1ruaq2 wrote

Children out of wedlock, children out of wedlock reproducing with other children out of wedlock, children born out of wedlock procreating with first cousins - the list goes on

Acrobatic-Bed-7382 t1_j1olp62 wrote

Well, I'm happy Arkansas has stayed relatively low, otherwise there's no way I'd have been able to buy a home this year! It was hard enough to afford it (in NWA) as is, so I'm lucky it wasn't worse!

Late_Advice_9793 t1_j1r8te9 wrote

But now you bought the house do you want the prices to boom

Acrobatic-Bed-7382 t1_j1r9you wrote

At this point, I don't really mind either way, because I don't plan on moving anytime soon. I'm just glad it stayed the way it was until we could buy.

SuperBethesda t1_j1ox98w wrote

Oregon’s growth is driven by Californians moving there.

xBris18 t1_j1piqoh wrote

What an ugly graph. I always thought this sub was about beautiful data and not just about "I copied some data into Excel and used the ugly standard formatting".

Sassy_chipmunk_10 t1_j1pr9nr wrote

This sub is 90+% look at this controversial or interesting data. Actual design has little to do with most posts. It's usually the most basic shit that gains traction and hits the front page at this point.

fred_fotch OP t1_j1qdnua wrote

Graphic design is not my strong suit unfortunately. Do you have suggestions on different design options?

xBris18 t1_j1qr4dl wrote

Sure, no worries. What makes a "good design" is highly subjective of course, but I think there are a couple of things that are super easy to do in less than a minute that would greatly improve the quality of this graph: First of all, edit the axes: Give both of them a solid black line and change the scale to start at zero. I would also add some tick marks. For this particular graph, I'd change the y-axis to start at zero and end at 2500 %. I'd set the main interval to 500 % and set the minor interval to half that (and make sure to enable both tick marks). I'd also change the width of the bars by setting the gap width to 50 % (standard is - for some reason - 219 %). I would also add tick marks to the x-axis. Maybe increase text size by at least 1 point and definitely change the text colour to solid black. If you feel fancy, change the font. Maybe add labels to the axes as well. A lot of these things are personal preference, but a good litmus test is to look at your graph at half or even quarter the size and see if you can still make out its meaning. If you can't, it's probably a bad graph.

So while I didn't find the exact data set you used, I found a similar one that I put together in literally two minutes: https://i.imgur.com/xIZbXCy.png - I do however like that you use the full names of the states, instead of the abbreviations I used - I just couldn't be bothered to look them up ;)

Also, maybe a map would have been the best format for this data. Also also, I honestly don't really understand the numbers in this. Is 2500 % a lot or not? I think the data should be in some form of context - compare it to inflation or purchasing power in general - something that puts it into perspective. 2500 % looks impressive, but maybe it isn't really. Humans aren't super great at estimating numbers over these kinds of time scales.

fred_fotch OP t1_j1qwh27 wrote

That does look better - thanks.

thelastpizzaslice t1_j1r9bz1 wrote

Doesn't account for changes in housing type over time or inflation, so this shows mostly those two things, rather than anything about the housing market...

[deleted] t1_j1o2l1j wrote

[removed]

[deleted] t1_j1ofq71 wrote

[removed]

[deleted] t1_j1ol9fp wrote

[removed]

lens_cleaner t1_j1osti4 wrote

Now I see why my rent has gone up by 5x in the last 25 years

[deleted] t1_j1owg0r wrote

[deleted]

Mainttech t1_j1oxzsj wrote

Just moved from one at the top, to one near the bottom. Bought a gorgeous house that met all of our needs. And with comparable wages. You can escape the top few states.

[deleted] t1_j1p5qcb wrote

[deleted]

cartersa87 t1_j1p6i3q wrote

Would be interesting to see this data compared to voting tendencies. Initially, looks like a lot of blue states are experiencing the largest price increases while red states remain relatively flat.

fred_fotch OP t1_j1p76lj wrote

I think it's mostly geography rather than political affiliation. Red states like Utah, Arizona, Montana and Florida are above average. The South and Midwest are below average. Overall, Blue States are higher but I think it's driven by geography.

cartersa87 t1_j1q2371 wrote

Gotta see the data

kaizerdouken t1_j1q12tb wrote

Would be interesting to see change in property taxes between 1975 and today. Blue places tend to pay higher property taxes due to them wanting to give more to others in their communities while red places would rather pay nothing and ask to be left alone in peace, therefore generally pay less in property taxes. Property taxes affect prices as new owners need to adjust prices to compensate higher property taxes.

fred_fotch OP t1_j1qe28c wrote

That would be tough because I don't think there is a good national property tax data set.

kaizerdouken t1_j1t9wa9 wrote

Well, one can manually gather the information from 1975, put it on a table then compare it to the now.

coronaflo t1_j1p8uue wrote

Compared to D.C., California and Washington perhaps but a 300 to 800 percent increase isn't what I'd call flat.

cartersa87 t1_j1q2cei wrote

Which is why I said “relatively”.

[deleted] t1_j1pj31y wrote

[removed]

toosemakesthings t1_j1pkvhu wrote

Is everyone reading this with their head tilted left at a 90-degree angle? :)

Null_error_ t1_j1pp5cr wrote

Is this adjusted for inflation?

[deleted] t1_j1puulr wrote

[removed]

jsm1095 t1_j1qkvab wrote

Do this vs cumulative inflation and avocado toast. I wanna show my parents there is a reason I can’t buy a house and it’s not because of my avocado toast.

The_Crystal_Thestral t1_j1ru0ru wrote

I feel like avocados only became expensive within the last 10 years. Before then I remember them being super cheap, like 10/$1 during their peak season at either a farm stand or a Hispanic market.

Mediatech5 t1_j1qrvs2 wrote

CA only has weather as a plus, for the most part. It is becoming more and more like Blade Runner with only the wealthy being able to afford housing. Those that leave and take their proceeds tomorrow affordable states are the winners. L.A. fuggetaboutit....

scarabic t1_j1r89me wrote

Yay migrate out to those red states and flip em people. God knows that cheap housing prices are just about the only reason to move there.

no_buses t1_j1ra6lz wrote

California’s population this year is lower than it was in 2016. So why the hell has the median house price nearly doubled in that time???

coldoldduck t1_j1rcx96 wrote

What’s happened to western Washington / tri county area around Seattle is completely disgusting. Everything historical or with any character or uniqueness demolished for land value, trees cleared and bulldozed, wildlife displaced while Karen calls 911 about a bear in her driveway (no shit, your new house is in his old house), ugly expensive McMansions and apodments and fake and bake subdivisions being snapped up for cash by corporations to sit there empty, widescale gentrification, the area natives being priced out, homelessness and tent cities everywhere, vomit and pee and shit on the sidewalks, drug use, crime and theft at a high, rushed urban density around new rail lines, idiot transplant drivers in their Teslas and dang freaking Polestars that lean on their horns constantly and cant drive in the weather….

Hi. I got a bit carried away. I may be slightly bitter at the “growth”. Get off my lawn.

theftnssgrmpcrtst t1_j1relqv wrote

DC is skewed because it's basically a city-state (sans statehood rights). It would be more appropriate to compare DC to the other major metropolises like SF, NYC, etc.

fred_fotch OP t1_j1rk5vl wrote

True. I made a city one in response to a similar comment https://www.reddit.com/r/dataisbeautiful/comments/zvt54h/oc_us_city_housing_price_changes_since_1991/

The data only goes back to 1991 though.

FreshInvestment_ t1_j1rg2k7 wrote

This is a bad graph. Why's it go to -200%? Where is 0? There should be a line for 0 or a different color for negative growth if there is any.

bee-dubya t1_j1rl1vo wrote

I’d like to see this for Canada. In my area of BC, it is probably at 4,000% or higher in places

CheerfulParadox t1_j1p08ip wrote

I'm genuinely surprised that Texas isn't in the top 10

fred_fotch OP t1_j1qdyuu wrote

I was surprised too. They also publish data for the 50 biggest metropolitan areas (starting in 1991) and Austin has the biggest price increase since then. Houston and Dallas are near the middle though.

bolteon593 t1_j1p66xs wrote

That’s gotta suck for everyone in not CA dealing with much shittier weather on the left side.

FarRelation3062 t1_j1q1k1g wrote

Real estate needs to be put in the basket for 2% inflation targeting. At that rate of growth, a typical US state wouldn’t even be up 100%, yet the lowest growth is around 300% in Mississippi. No wonder people are homeless and destitute.

ShinjukuAce t1_j1qc3wi wrote

Good graph, but metro by metro would be a better indicator. Statewide housing prices don’t tell you a lot - New York state for example varies hugely by neighborhoods within New York City versus different suburbs versus rural areas versus other cities like Buffalo.

fred_fotch OP t1_j1qe9m1 wrote

True, but the metro data only goes back to 1991: https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index-Datasets.aspx#qat

Think-Mountain1754 t1_j1qm4k3 wrote

In trying to eyeball Arizona growth rate, I realize the scale is terrible.

fred_fotch OP t1_j1qxltc wrote

Yes, the scale makes no sense haha. Arizona was 1065%.

[deleted] t1_j1oryfy wrote

[deleted]

SuperBethesda t1_j1ow8h5 wrote

Recessions usually result in interest rate declines. Fiscal stimulus.

RxStoney t1_j1oxxys wrote

Oh my.. 😳 You said the "R" word.

J/K I hope you're correct. We'll see where the ball bounces by spring

MojaveMark t1_j1pq0xx wrote

"in your lifetime"? Really?

Something tells me this comment won't age well.

BastardChicken1 t1_j1ppm67 wrote

State by State in the USA*.

/r/USDefaultism as per fucking usual.

fred_fotch OP t1_j1qecj8 wrote

I am not American if that makes you feel better.

chez-linda t1_j1o6xl9 wrote

Sometimes Mississippi has it nice being at the bottom of the list