Comments

Obsidianram t1_j97jrqc wrote

If this was a polygraph....

69420ballspenis t1_j97ls5n wrote

Spy back in the 390 range end of first week of March

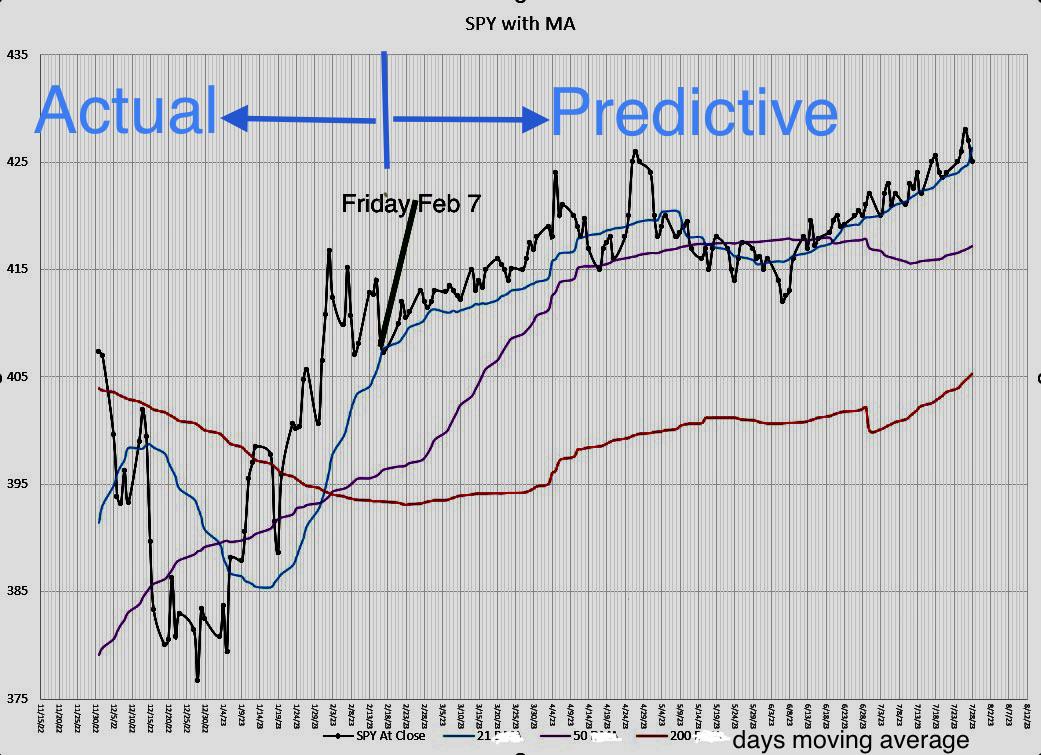

Dry_Job_1084 OP t1_j97mynj wrote

I tried plotting that scenario but it didn’t work from a technical perspective from where it is at the moment. It would be something like a black swan event that would make the 50 day moving average sink quickly under the 200 day moving average when it just crossed it going upwards a couple of weeks ago. So maybe if Putin does use nuclear weapons that could happen, or if the U.S. president dies, or the debt ceiling drama escalated and US defaulting on its debt. That last one will not come until June-July. That’s why my graph shows a dip in those months.

69420ballspenis t1_j97psp1 wrote

Fed minutes Monday (likely up and down and no real movement) PCE comes out Friday. PCE comes in hot and we start to break 4050 on SPX. It doesn’t take a black swan event for institutions to capitulate when data shows companies don’t deserve 20-30x PE ratios. Golden cross is a dumb indicator in and of itself when economic data suggest there’s reason to be speculative of a bull market.

[deleted] t1_j9858j7 wrote

[removed]

BugTotal6212 t1_j988qzb wrote

The market Is volatile af. No direction just chop. Probably 380 to 430 all year.

Dry_Job_1084 OP t1_j989dxz wrote

Yes, agreed. But SPY will not go down to $380. That’s below the 200 day moving average. It will stay above that line in the next few months.

Dry_Job_1084 OP t1_j989z6m wrote

The day marked on the graph is supposed to say Friday February 17 (last trading day before the predictive analysis). Sorry for the typo.

WayPitiful7353 t1_j98fy6x wrote

You forgot a huge leg down for my PUTs to print!!!

Dry_Job_1084 OP t1_j98g4pd wrote

I’ll add it in. Don’t worry, it will be in by market open on Tuesday

Exonerated_living t1_j98hal0 wrote

My calls hope you’re right bucko

daco_taco t1_j98hgom wrote

Guess we will see

[deleted] t1_j98jb8v wrote

[deleted]

EconGuy82 t1_j98lmjk wrote

Can confirm. We will see 320 in the next couple weeks, then huge bounce.

No_Working_6660 t1_j98nh1d wrote

Did you put some money where your crayons is?

Dry_Job_1084 OP t1_j98o3po wrote

I invested little last week on calls on RTX and bought BA and GD shares. Also bet on travel, JETS and OOTO. Took the weekend to look at it, so that I’ll know how to position this week. Thinking of just buying 3x leverage ETFs: SPXL and TQQQ

_Kenway t1_j98or41 wrote

This is actually a good prediction, but 400-405 might be tested bc in a flat market scenario the 50 MA does not work that much as a support

[deleted] t1_j98q4xz wrote

[removed]

GetRichOrDieTryinnn t1_j98yc17 wrote

Crayons are yummy

Sour-Bitter-Confused t1_j9968g7 wrote

Is this brand name Crayola? If so

KutteKiZindagi t1_j99kexu wrote

> technical perspective

technical analysis is astrology for dumb investors. at best, it's a red herring used by large funds to create bag holders.

I am not saying you are wrong or right and FWIW you could be right. But it's not because of TA

Dry_Job_1084 OP t1_j9a90hw wrote

I’m looking at SPY data starting in February 1993 through today. TA and the 50, 200 day moving average “theory” has held up over the last 30 years. So maybe now it breaks, who knows! But I don’t think so.

BurningThad t1_j9atjqx wrote

... you realize those lines changes to best fit the trendline...

Because of that, it's always going to fit historical values... Whether it will 100% predict tomorrow is a guess... But know this, once tomorrow happens , the MA of the past weeks will change to fit lol.

Hence the term, "moving average"... when there's no data to plot, it can't tell you much. You can only speculate.

If you don't understand what I mean, maybe look at how it's calculated.

assclown356 t1_j9b3w6f wrote

So if prices on goods have doubled, why hasnt the price of stock not doubled?

Dry_Job_1084 OP t1_j9b4zyo wrote

We might need a degree in Economics and one in Finance to explain that! But, let’s keep things simple. Look at the value of the dollar in the FX market. Right now it is around $103 in relationship to other currencies. When the dollar drops stocks go up and when the dollar increases stocks go down. The dollar was at $116 in October, so it went down to $101 and stocks went up. Then over the last couple of weeks it has gone a little up to $103 so stocks dropped a little. The dollar NEEDS to get under $100 soon to not crush emerging markets. When it gets under $100, global markets work optimally and US stocks will be in a bull market again. For now they’ll be steady around this range until it drops under $100.

leli_manning t1_j9bq7li wrote

If you look closely at the TA, it clearly says 🌈 🐻 are fukt

Dry_Job_1084 OP t1_j9cxwhv wrote

Yes, I understand how it’s calculated. I obviously wrote the same formulas used to continue calculating it adding in the predicted future daily values. Maybe, you don’t understand how it’s calculated and you don’t understand that a whole week of trading is only 1/10 of the 50 day moving average. So one week or one day can’t skew it much.

Dry_Job_1084 OP t1_j9cy2lr wrote

burn15_ t1_j9dpf4r wrote

It's literally sitting at $407. If it drops $1 tomorrow you already lose.

Dry_Job_1084 OP t1_j9eu95k wrote

I wouldn’t call it lose! This is not meant to be an exact day by day prediction. As long as the week is directionally correct, this will hold.

GWiz999 t1_j9f4cqc wrote

My 3 year old with crayons can scribble better lines than this.

Dry_Job_1084 OP t1_j9f4tek wrote

It’s Excel. Puts on MSFT then!

burn15_ t1_j9g9cdm wrote

I'd say it's already over for you

Dry_Job_1084 OP t1_j9g9jyb wrote

Again, we shall see. Patience. Sit back and watch.

69420ballspenis t1_j9gdk3y wrote

I think so. On account of it did. Back to 390s before end of first week of March. And here we are.

Dry_Job_1084 OP t1_j9gl9m8 wrote

Not $390s. It’s barely under $400. But if you are so sure it is going to $390, you should buy puts. $390 strike expiring this Friday is going for $0.70. Super cheap. Go for it!

69420ballspenis t1_j9hvck3 wrote

Isn’t just under 400 in the 390s? I can tell you it sure as shit isn’t 407-427. Sorry your ego is hurt. I’ll just continue to hold my July 405 puts I bought back in the 410s because I’m not a broke gambling regard and can afford theta.

Dry_Job_1084 OP t1_j9jb9zi wrote

That is definitely better than 0DTEs. Good job! You should double down on that play. I have a well seasoned ego, not easily bruised, no worries.

burn15_ t1_j9l779y wrote

At what point is it no longer $407.

Dry_Job_1084 OP t1_j9mmyz8 wrote

My prediction is for 6 months, not for 2 days. So closing price today at $308.54 is 2% under what I predicted as a low ($407). If I am wrong by 2% for a week out of 6 months, I consider that a win. Specially if I’m correct for the other 5 months and 21 days. Don’t you think it is too early for conclusions on a 6 month prediction made 2 trading days ago? Now, if in a month SPY is down to $380, then I would be the first to say that I was wrong. But, if in the next 5 months SPY makes it to $427 or higher and stays above $400, I will consider my prediction for the 6 month period pretty darn accurate.

burn15_ t1_j9n0mr5 wrote

But your prediction says that it will stay between 407-427. Not 380-450. Why put numbers there if they mean absolutely nothing

Dry_Job_1084 OP t1_j9oavvu wrote

Impossible to explain predictive analytics to you I guess. All predictions of the future come with a margin of error. A 5% margin of error in a predictive analysis is extremely good. I should know. I do this for a living. Not in financial markets, but in business trends and inventory management. Same skills, different datasets

burn15_ t1_j9p732u wrote

Did predictive analytics tell you to buy workhorse at $14/share? Currently $1.96

Dry_Job_1084 OP t1_j9pf1os wrote

Hell no! 😂 Made good money with that stock about 2 years ago. That one and SPCE were cash cows back then!

burn15_ t1_j9tkl5n wrote

Down to $395 my man. A far cry from $407. I once again would call this over before it began.

burn15_ t1_jaeoog7 wrote

Now is it over?

VisualMod t1_j97hkbf wrote