Submitted by Surlax t3_11e65gn in wallstreetbets

Comments

Surlax OP t1_jact506 wrote

Calls on Dua Lipa

MrStealYoBeef t1_jacug8n wrote

That's the good shit right there

ethanhopps t1_jaetajj wrote

It's ok to be a simp and still be sigma if it's simping for Dua Lipa, trumps all

LegendsLiveForever t1_jaf0gu8 wrote

Yes, pumping a trillion dollars into the private sector via interest rates (govt is a net payer of them), should definitely slow down inflation. Nothing like pumping $1T into the economy to slow it down. The loan trend should be downwards then, yes, even slightly so if hiking rates effected loans negatively. That is the Taylor Rule thesis correct?

Let's see how 1 year of rate hikes worked on our loan applications: https://ibb.co/64Srz64

https://twitter.com/patrick_saner/status/1628690771141328897?s=20

Rate hikes increase inflation, (esp w/ a high ratio of debt/gdp, interest rates are expansionary), put more money directly in the hands of loan writers. Who increase their income, just like a bond investor might invest in bonds, by writing more loans.

This is old-school economics, and it's just plain wrong, along with a whole other bunch of theories from the 90's. Economics' isn't a science, and even if it was, this wouldn't pass any litmus test.

attofreak t1_jacjngq wrote

The Feds just as easily might do away with it too. If holding the interest rates at even 5% does enough damage to bring inflation down over the next 2 years, they will consider it a "success". And the moment they even decrease rates once by 25 bps, markets will lose their minds and rally to new highs. We are entering a new era now, where "Japanification" of American and in turn global economics is underway - hopefully, a very slow process unfolding over several decades before we sell next few generations for our immediate needs. The classic debt cycles will be abused worse than rule 34 hentais about Sammy the assistant.

Ohmaygahh t1_jadcaai wrote

The moment there is a first rate cut , markets are GOING TO LOSE THEIR MINDS! SPY instant +37% in a day.

RockyattheTop t1_jadnl1l wrote

Easiest short of all time then. FOMO crowd is left poor, and bears are the new gurus of Wall Street. Fed doesn’t cut rates because they felt cute and decided to be nice, they cut rates because at some point something breaks and it’s them trying to clean up their mess. Happens everytime they raise rates repeatedly

Brickolas_Cage t1_jadxvhh wrote

EaSiEsT sHoRt Of AlL tImE

RockyattheTop t1_jadydkf wrote

Do it, please FOMO buy in when they cut rates. Only call options, no shares. I can’t wait to see you go tits up

Brickolas_Cage t1_jadz83d wrote

It might be in a year it might be in 3 years. It might be after a 30% crash. Wahhh short it

AutoModerator t1_jadz84h wrote

how about u eat my ASS

I am a bot, and this action was performed automatically. Please contact the moderators of this subreddit if you have any questions or concerns.

Ohmaygahh t1_jae0mph wrote

EXACTLY! Right now there is a short term pressure of FOMO by all the people who think they are smart waiting on the sidelines. Too much money waiting for better prices. Stocks will moon just enough that the buying starts again and it's a new "bull" market that defies logic.

Then the true dump begins.

RockyattheTop t1_jae27a1 wrote

Wall Street has to offload their bags. They aren’t stupid and are way better with math and economics than the rest of us. They see where this shit shows going. Once they can unload a bigger portion of their holdings onto Main Street they can start to dump their shares, and will plan on buying up the shares they just sold to retail once the market is down another 30% and retail capitulates.

Surlax OP t1_jack1ul wrote

In addition to all of the above, it appears reasonable for the Fed to raise the “target CPI” up to 3-4% and call it a day

randompittuser t1_jacoz6p wrote

Powell said that’s not happening

[deleted] t1_jacwazn wrote

[removed]

[deleted] t1_jads2pt wrote

[removed]

TwoAccomplished t1_jae3104 wrote

He said 0.75 beep hikes were not happening either, then did it 4 times in a row.

randompittuser t1_jae4u05 wrote

I'm convinced most people are incapable of comprehending nuanced language. Here's what he said regarding 75bps rate hikes in March 22:

"A 75 basis point increase is not something that the committee is actively considering."

And here's what he said about raising the target inflation rate:

"We're not considering that. We're not going to consider that. Under any circumstances. We're going to keep our inflation target at 2%. We're going to use our tools to get inflation back to 2%."

So, you see how the first statement wasn't a dismissal of 75bps rate hikes? But rather a statement about what's been presently considered? There's a lot less nuance in the second statement.

Due-Employee9272 t1_jaclqs7 wrote

Depends, the target has always been 2% and if the fed goes changing the target, it will be seen as moving the goal posts because you can't win. Fed would lose credibility quickly.

paradox246 t1_jacwipa wrote

They can't lose what they don't have.

konstantinos2000 t1_jad1qxo wrote

[deleted] t1_jacufpk wrote

[deleted]

Javier-AML t1_jaej266 wrote

Ha, many think that recessions are worst than inflation.

AdDiscombobulated234 t1_jact3dp wrote

Instead of this why wouldn’t the fed just rip the bandaid off and raise rates +200 bps in the next two meetings? Not being a smartass just actually a dumbass and don’t understand

BossKitten99 t1_jacvbcw wrote

1.) They don’t want to crash the real estate market 2.) Crypto is still a threat to the dollar

Terbatron t1_jad35sz wrote

People can’t afford homes, the housing market needs to crash.

BossKitten99 t1_jaddw72 wrote

I agree, but lets face it, people are still paying these ridiculous prices, both in sales of homes and rent. I really feel bad for the renters getting waxed. Perhaps that is why so many are desperate to purchase a home in order to at least “keep” the money they pay each month

Rough-Grape188 t1_jado3vx wrote

Fixing the real estate market will not fix the value of the USD. Still have to pay high energy costs, utilities, and insurance.

Random-Redditor111 t1_jae8gyw wrote

They don’t care about the people buying homes silly. They care about current homeowners having their home values rise to infinity.

BossKitten99 t1_jaed27e wrote

They only rise to infinity as long as demand is infinite. Jacking interest rates are to limit that demand. Too high, too quick and that demand dies . Home prices are not what they were in the 80s

BestAhead t1_jaejjf8 wrote

There is a shortage of homes. Isn’t it arguable that those who can afford them should have the homes?

Xavieros t1_jad1twh wrote

Who's going to want to hold crypto when you can earn a safe 5%+ per year on your savings acc?

SufficientTowers t1_jad2mr5 wrote

People worried about the longterm survival of the USD. It's status as the global reserve currency has never been threatened to the degree it's at today.

DigitalSheikh t1_jad8zwv wrote

Old news- we crushed Russia, rebuilt our alliance with Europe, and isolated an economically weakened China. We’re back to 100% secure for at least the next ten years, maybe longer.

SufficientTowers t1_jad9odt wrote

Europe was never the threat to the USD, it's moreso players interested in subverting the petrodollar (some of the BRICS countries and players in the Middle East). Without the petrodollar the inherent faith that props up the USD as a global reserve vanishes.

Russia is far from crushed, be mindful of propaganda. The real variable is whether or not China chooses to ally with them as part of an anti-Western axis or chooses to betray them while they're vulnerable.

Hacking_the_Gibson t1_jadcqwg wrote

Dawg, the US has 15 or whatever carrier groups.

The only currency is violence. If the Middle East fucks with the dollar, we will just kill them.

SufficientTowers t1_jadd4bz wrote

The US military hegemony is only as strong as its ability to fund that. Just printing an extra trillion dollars or so in a year has nearly broke the entire domestic economy, there's no way the US could mount a multi-front war at the moment.

Not to mention that such a conflict would rapidly increase the speed of adoption of US-alternate currency options.

Micheal_Bryan t1_jaf2kmz wrote

Like Hell we couldn't. That is our literal battle plan. You have no idea.

[deleted] t1_jadsih7 wrote

[removed]

DigitalSheikh t1_jadvows wrote

Russia can’t even handle our second-line weapons being given in relatively small numbers to a country a quarter of its size. What we found out from Ukraine is that the Russian military is laughably weak in comparison to NATO, and that’s not even speaking of the US military. Poland could apparently solo Russia no prob, based on what we’ve seen in this conflict.

China has an even worse position, since any war with them would involve them needing to make a landing on a hostile country that has shitloads of missiles and the support of the largest navy in the world by 10x.

SufficientTowers t1_jadw677 wrote

That is the exact propaganda I am talking about. It's not actually true. But that very propaganda helps feed the narrative needed to keep supporting Ukraine financially.

If you don't believe me then set a reminder for yourself a year from now when Russia mysteriously emerges as the victor.

DigitalSheikh t1_jaeclhf wrote

https://www.oryxspioenkop.com/2022/02/attack-on-europe-documenting-equipment.html?m=1

Lists of equipment losses and casualties supported by photos for every one are hard to describe as propaganda. Russia’s running up almost 2000 tanks lost- at least half their serviceable fleet if not more. Comparable losses in other equipment, usually a third of it was captured by Ukraine. That’s not what a competent power looks like, and no, they’re definitely not gonna win, unless maybe taking just the Donbas at the cost of 200-300 thousand people is a victory

SufficientTowers t1_jaee7a4 wrote

That's a data point in isolation. You haven't heard the alternate explanation for those things so it's natural that you would see those as justifying your worldview - that is exactly how good propaganda works.

Look up Russian military tactics, going back 80 years. They use the attrition model of combat. They send overwhelming numbers (using their most expendable soldiers and equipment) knowing that statistically an opponent of even half the population cannot win against those tactics (this is well established military doctrine in the US as well, btw). In the West we don't consider such tactics ethical but they do in Russia.

If you don't believe me go look up Russian losses in WW2, Afghanistan, Syria, etc. They all used the same tactics.

I want you to keep this conversation in the back of your mind for a few months from now. You will be confused how Ukraine "suddenly" lost. The MSM will have an explanation for it that you will likely buy into. Think about how I know all this before it's happened.

Micheal_Bryan t1_jaf2tj0 wrote

you keep telling everyone to nOt LiStEn 2 PrOpoGaNda, but all you spout are anti-American russian sound bites, and it is so blatantly obvious that i am reporting you for that.

GhostReddit t1_jadfh9a wrote

No one without brain worms is more concerned with the longterm survival of USD than a highly manipulated speculative asset.

SufficientTowers t1_jadfwnt wrote

All currencies are highly manipulated speculative assets (George Soros famously got rich by playing the GBP).

The only difference right now is that cryptocurrencies aren't treated as currencies...yet.

BossKitten99 t1_jadegj0 wrote

5%+ means nothing when inflation is currently above and steadily outpacing that figure

ACiD_80 t1_jadfc8j wrote

As always

[deleted] t1_jadscct wrote

[removed]

exotic801 t1_jaddpi9 wrote

First point, as someone going into the labour market, sounds fantastic. Iz crypto really that much of a threat still? I thought it was pretty clear that it was a largely unregulated market and that it would need some major changes to become valid currency(I could be very wrong)

ACiD_80 t1_jadfndo wrote

Its unstable and thus a gamble.

The negative sentiment towards crypto is growing fast.

Crypto is great if you want to hide shit.

Micheal_Bryan t1_jaf3ab3 wrote

if you want to hide shit, do not do it on a permanent ledger...that is the opposite of hiding...

oldrocketscientist t1_jaej2cw wrote

There is no place to hide. Crypto is on life support.

Javier-AML t1_jaejoh8 wrote

So it's useful if you are a warlord, drug dealer or a billionaire.

ACiD_80 t1_jaevwj1 wrote

in short, yes... also, hacker of course

Javier-AML t1_jaew95t wrote

Yeah, those nerds too.

[deleted] t1_jadso7a wrote

[removed]

Micheal_Bryan t1_jaf369u wrote

don't listen the guy that is predicting russian victory, and that the American military can't fight, he is obviously a russian shill.

I reported him for misinformation, and you should too.

BossKitten99 t1_jaee3l7 wrote

The instability you mention - is that related to the recent debacle of FTX? These kinds of negative publicity stunts are manufactured as a way to dissuade the laymen. Actual blockchain/crypto currency can’t help but be stable

exotic801 t1_jaek4kl wrote

Not just ftx, the market in general seems to have a lot of fraud and as of now it seems like it's too easy to magically make money appear(hyperbole).there's also that most stable coins that I know of are backed based on usd or some other currency, which is a problem when talking about cryptocurrency becoming the new global currency.

I also personally dislike the technology and the people leading the charge, I don't think privatized currency would be a good thing for most people, so in my view a govvy run cryptocurrency just seems like worse money.

Feel free to tell me why I'm wrong though, I've done enough research to form opinions but not enough to be sure about them

Micheal_Bryan t1_jaf3jvx wrote

what hopium are you taking? there have been a series of hacks, and entire companies dissolving, and you claim it is all a show?

Tell that to Sam bankman...freaking idiots here eating that tripe...

OkayTHISIsEpicMeme t1_jadu410 wrote

Crypto now directly correlates with interest rates it would crash with the market

BossKitten99 t1_jaeccji wrote

Right… 😉

paradox246 t1_jacx1gc wrote

Because they only pretend to fight inflation, think for a moment who created this inflation in first place.

randompittuser t1_jacoytd wrote

Powell said that’s not happening

Surlax OP t1_jacphie wrote

Isn’t it the same guy who assured the public that inflation is only transitory?

Rich4718 t1_jacrmum wrote

It is, transitory means not permanent. Since the end of time hasn’t been witnessed yet if it ends anywhere before that, it was technically transitory.

Surlax OP t1_jacsfsu wrote

Technically correct, best type of correct

[deleted] t1_jacwfil wrote

[removed]

Qzy t1_jad85f2 wrote

In before inflation persists through the end of time.

Muhahahaaa.

RtardedAPE t1_jadangb wrote

This is the dumbest argument I've ever seen.

PillarOfVermillion t1_jacsnfu wrote

>Sammy the assistant.

I'm honestly curious, but also not sure if it would be a good idea to Google it 😆

DougyRoss1980 t1_jacuznp wrote

Can you elaborate on what you mean by "Japanification"?

attofreak t1_jad01to wrote

The Central Banks basically inflating the economy with NIRP and mindless QE + loan programs, year after year, decade after decade, while we live in a low growth/low inflation environment. There were fears that would be our fate for a while now, and then suddenly this supply side constraints and sudden increase in demand shook things up. Newer generations are not only holding off on having kids, bringing down birth rate, they are also delaying participating in the conventional credit cycles, choosing a less productive lifestyle in non-STEM, non-business careers (trade schools etc), which is creating a talent gap (for now, USA can still fill it with immigration, and then the right-wing nuts lose their minds without seeing the bigger picture).

Everything is running on debt more than actual growth: the markets react positively to bad news because it means debt will be cheaper when Feds relent and decrease rates eventually. Corporations are spending money on share buybacks and monopolies pretty much hold the economy hostage. Tech used to lead the pack in growth because there was so much to reap from just Moore's Law scaling. Now we are at the end stage of that, plus a saturation of mobile computing and cloud computing. What we are left with are dubious future tech and protocols, which are desperately creating problems to solve than the other way.

Feds are way more powerful than BOJ, so they can still get away with most of it. And USA got their buddies in EU and western world to ensure it maintains dominance over rest of the world, while "outsourcing" its misery to the poorer countries in due time. But with rise of China, Asian and African countries finally have an alternative to the oppressive/meddling shenanigans of west. An open challenger stands in the way and the curmudgeons in American politics barely know how to respond besides the sanctions and bullying tactics - which China is using to its advantage to corner its part of the world.

EDIT: triggered the idiots already. You guys are a parody of yourself.

FeelTheH8 t1_jad4kme wrote

You lost me at saying trade school careers are causing us to be less productive. Having a good supply of competent people building and maintaining the country is a value add, not a subtraction...

QuantumWarrior t1_jadc0ix wrote

Didn't you know? Tech bros and middle managers are more productive than builders and plumbers and electricians.

FeelTheH8 t1_jadcy2n wrote

And they can do their work without working buildings, electricity, or plumbing! I mean, it's working fine right now, what do we even need trades for??

attofreak t1_jad586z wrote

Construction of buildings, putting plumbing lines, electricity outlets is not driving a country's innovation and tech lead, as shocking as it may be to comprehend that. This is such an inane comprehension of real world, I don't know where to begin explaining how stupid it is. By your "logic" - not even worth calling that, schools failed you terribly - developing countries should be world leaders because they are in fact overcrowded with low-skilled workers.

FeelTheH8 t1_jad79i9 wrote

Shoddy or delayed construction, plumbing, or electricity is a massive drain on the economy of a country. If there is a massive shortage of workers willing to even do the work and a lack of people with a couple brain cells to rub together entering the field due to your ridiculous mindset, the innovation and everything you rely on is not possible. Also, the trades wouldn't be paying such outsized wages if there wasn't such a need for them. Your argument makes the assumption you can remove the middle levels of the scaffolding and add to the top to help a country move forward.

The_Punicorn t1_jaemr6e wrote

You heard it here first gentlemen. You don't need basic infrastructure to be tech leaders and innovators. Candles and Papyrus only.

SufficientTowers t1_jad4f9c wrote

> for now, USA can still fill it with immigration, and then the right-wing nuts lose their minds without seeing the bigger picture

There's a touch of irony here. There's an even bigger picture you're not considering here that the "right wing nuts" are in the right about; longer term downward pressures on wages due to infinite labor supply, elimination of whole sectors of industry, as well as strain placed on social systems by importing net unproductive people. The immigration system in the US does not select for the best and brightest globally, unlike immigration systems in most other countries.

Comparative advantage needs to be held up against localized losses. It doesn't matter to the unemployed that everything is 10% cheaper when their jobs are eliminated and there's no path to retraining.

attofreak t1_jad5nvd wrote

> net unproductive people.

lol, the "unproductive people" are the privileged white demographic. You are getting engineers, doctors, professors, phd students on scholarships and affluent families as your immigrants, while you squander away your stimulus checks on 0dte plays.

But keep licking up to the right-wing nuts, who do everything possible to make your life difficult, ensure terrible wages, fuel up military industrial complex stealing funds from the most basic social support system and write corporations blank checks.

The irony, if you knew how to use that word, is not realising how you are exactly the lazy, privileged, misinformed idiot that is a product of a failing system.

goldenloi t1_jad6cu7 wrote

>You are getting engineers, doctors, professors, phd students on scholarships and affluent families as your immigrants

Only about half of US immigrants have graduated high school (or equivalent)

SufficientTowers t1_jad6a4j wrote

> You are getting engineers, doctors, professors

Tell me you know nothing about US immigration without telling me you know nothing about US immigration.

> the "unproductive people" are the privileged white demographic

The Left sure does a great job proving they are anti-racist people who care about the little guy....oh wait

>you are exactly the lazy, privileged, misinformed idiot

You got literally everything wrong. You are a white guy who has enough disposable income to mess with options trading.

The amount of irony here is palpable.

thepiguy17 t1_jae12y8 wrote

Jumping in way late to say I don’t think anyone in politics is looking out for the interest of common folks, immigrants or otherwise. It’s all a façade. Then we argue with our neighbors about who is right and who is wrong all day, while those fuckers collect paychecks from our taxes. The remainder then gets funneled to big business because we need privatized companies to help the government do its fucking job, and while they figure out who is going to get paid, they all shovel every dime they can into the market to collect a fat premium on the “work” they did for the American people.

Fuck ‘em. Seriously, both sides are just as corrupt, just as immoral, and just as bad in completely different ways. Congress, and all politically appointed representatives should make minimum wage and not be able to participate in anything other than buying ETFs or throwing shit into a savings account.

SufficientTowers t1_jae1hd7 wrote

Couldn't agree more. Government being a necessary evil that needs to be as impotent as possible seems to be the only valid take.

konstantinos2000 t1_jad1laf wrote

What do you mean by Japanification?

RtardedAPE t1_jadbmki wrote

Google the Japanese asset bubble, it fucked their economy for like 20-30 years.

[deleted] t1_jadqubd wrote

japan's stocks have no where near the coh and stability that american companies have.

it's like saying ARKK was a bubble, therefore the US must be a bubble. completely unrelated.

RtardedAPE t1_jadtlcj wrote

Dude asked what "japanification" was, i explained, and the "everything bubble" is pretty well documented wtf are you going on ARKK about lol. The US has a recession every 10-15 like clockwork try reading a fucking book or something Mr. stability.

[deleted] t1_jadtq1n wrote

guess you got it all figured out. you can resign from your wendys position!

RtardedAPE t1_jadzvt2 wrote

I just got promoted to shift manager

[deleted] t1_jadzyiv wrote

CONGRATULATIONS

Javier-AML t1_jaeilhi wrote

Japanese thought the same about their companies, that's what pumped them in the first place.

[deleted] t1_jaeiwd3 wrote

and their P/E was 60.

for reference, spy is only at 21.

so if SPY pumps to $1,200, then yeah I would absolutely sell off and divest.

Javier-AML t1_jaelxmw wrote

Ha, tesla has a PE of almost 60. They flagship of usa stonks.

[deleted] t1_jaem5ec wrote

tesla is not sp500.

wonderfulwilliam t1_jaekcpf wrote

Micheal_Bryan t1_jaexsq6 wrote

This song has been stuck in my head since the eighties...

JCGolf t1_jad3pza wrote

typically when the fee cuts rates is during an economic free fall

Kevatre t1_jadnjif wrote

I secretly hope for 10-15 years of SPY chopping after which conditions finally ease and SPY hits $600 where I can unload my bags, sit in cash, and cherry pick stocks to carry into retirement as I wish.

furrypurpledinosaur t1_jacrq05 wrote

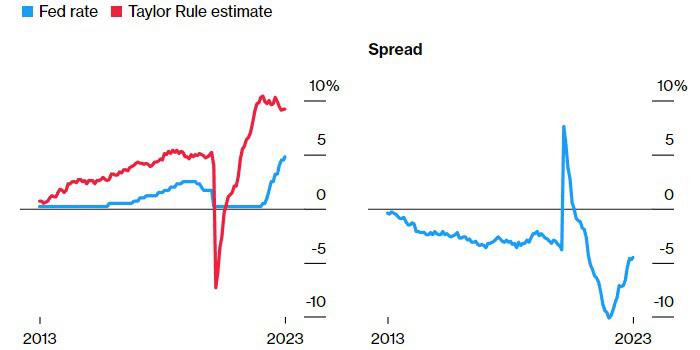

You can see that Taylor rule overshot to the downside by a lot so it makes sense it overshoots to the upside. Fed rate will not go that high.

x___tal t1_jae311z wrote

Maybe it's the fed rates that overshoot because they are regards like us?

MrSamsonite t1_jae60uc wrote

Sure, but when it overshot the downside, it immediately corrected itself. If your logic is correct, wouldn't we have expected the Taylor Rule to shoot back down already?

Obviously I don't expect a 10% rate, but those two lines converging around 7% seems reasonable and horrifying.

furrypurpledinosaur t1_jaeipuk wrote

Not yet, I think inflation is still high but the amount of disinflation already in the pipeline is eventually going to show up in numbers and once it starts going down it goes down fast. That's only my opinion obviously, I don't know what will end up happening.

Born_Wave3443 t1_jactc76 wrote

Taylor Swift is involved in large scale finance/economics?

technoexplorer t1_jacucrw wrote

Always has been.

ACiD_80 t1_jadgtuq wrote

She's the only reason why the US economy hasn't collapsed yet

Due-Employee9272 t1_jack97z wrote

I don't think the Fed is aiming for that. Estimates are 5.4% by July it seems and then hopefully there will be good enough data to pause.

SufficientTowers t1_jad4sq6 wrote

It's worth reminding everyone that inflation is a YOY rate of change metric. If everything goes up 10% in year one and then another 5% year two, the reported inflation rate will be 5% despite everything having gone up 15.5% in two years.

With enough time inflation will eventually "come down" so a decreasing number is misleading with regards to how much stuff increased in cost.

PAM111 t1_jacltoi wrote

We are experiencing stagflation. This is the worst case scenario because the Fed waited to long to act.

prettyprtyprtygood t1_jad2zfx wrote

It's pretty clear that we aren't experiencing stagflation. In stagflation, the inflation rate has to keep increasing even as growth slows, and stagflation is specifically characterized by high unemployment and high inflation at the same time.

​

Unemployment is low, inflation rate is decreasing as growth slows, and the inflation adjusted GDP is still growing. The only argument for stagflation is that everyone is lying about everything and that the government is controlled by lizard people.

ACiD_80 t1_jadhb17 wrote

Dont forget the gay frogs

MoondropS8 t1_jad2mki wrote

You’ll have to wait until unemployment gets bad to call it that

goldenloi t1_jad9vra wrote

A lot of people think the current numbers are BS, myself included. At very least, they don't reflect the true state of the employment market because of the way they are calculated.

But you're right. I think it will get there in the second half of this year.

phony_squid t1_jadcy2i wrote

That’s what I’m waiting for. I’m not worried until or unless unemployment really heats up. The way I see it, the economy is currently working for almost everybody.

PAM111 t1_jad2u8g wrote

Technically true. I believe we've locked in conditions that ensure this. Fed is too pussy footed to do what's needed. Remember transitory?

Due-Employee9272 t1_jadar2c wrote

Agreed on the fed taking to long to act, it was a dangerous choice.

As for stagflation, you're technically wrong but I agree with you. If we didn't have a pandemic where it was hard to find workers, we wouldn't have companies hoarding employees like we have now. But over time, I expect unemployment to rise as the rate increases take effect.

Sad_Chest1484 t1_jad2044 wrote

This is stupid. It is the neutral rate at time = 0, doesn’t mean the fed will hike there. The right way to look at this is to see where implied fed funds is versus inflation break evens to back out if fed funds are restrictive or not. They currently are.

TheDudeAbidesFarOut t1_jaclx2g wrote

Calls? Puts? Explain like I'm five

ddroukas t1_jacsap7 wrote

Both. And you’ll still lose money.

TheDudeAbidesFarOut t1_jad0yw0 wrote

Theta fucking it is. Loading up.

SuboptimalStability t1_jad5vnh wrote

It's a nessy formation so iron condors

[deleted] t1_jacpnnm wrote

[removed]

ticapnews t1_jadefcb wrote

I'm waiting to see what Beyonce says.

Great_Jicama2359 t1_jacv44m wrote

What does this mean?

VisualMod t1_jacj2qn wrote

| User Report | |||

|---|---|---|---|

| Total Submissions | 1 | First Seen In WSB | 5 months ago |

| Total Comments | 3 | Previous Best DD | |

| Account Age | 4 years | [^scan ^comment ](https://www.reddit.com/message/compose/?to=VisualMod&subject=scan_comment&message=Replace%20this%20text%20with%20a%20comment%20ID%20(which%20looks%20like%20h26cq3k)%20to%20have%20the%20bot%20scan%20your%20comment%20and%20correct%20your%20first%20seen%20date.) | [^scan ^submission ](https://www.reddit.com/message/compose/?to=VisualMod&subject=scan_submission&message=Replace%20this%20text%20with%20a%20submission%20ID%20(which%20looks%20like%20h26cq3k)%20to%20have%20the%20bot%20scan%20your%20submission%20and%20correct%20your%20first%20seen%20date.) |

[deleted] t1_jacjzdw wrote

[deleted]

workinguntil65oridie t1_jacrx58 wrote

Part of my thought this was the Taylor swift estimate.

captainadam_21 t1_jacu86b wrote

She needs to write a breakup song about inflation. Maybe that will make it go away

davesmith001 t1_jacx11u wrote

Only 5% away. Barely over the half way mark.

divurchic t1_jad1qq9 wrote

John Williams - Shadow Stats; he says inflation is 16%… US Government playing games with Stats. Millions of people will be loosing Covid-19 SNAP benefits in March. Covid SNAP benefits kept people out of poverty, that is not factored anywhere.

konstantinos2000 t1_jad1fkt wrote

What is the Taylor rule?

SuboptimalStability t1_jad5y60 wrote

Don't ask don't tell

konstantinos2000 t1_jadaij6 wrote

Why?

Rim_World t1_jad29jt wrote

spread them cheeks

crugerdk t1_jad8c10 wrote

The obvious take away from that, is that Taylor is shit at estimates

HousingAggressive t1_jadep3u wrote

IMO today’s situation is immensely different from the Volcker era. Being a fan of Volcker I believe JPow knows exactly what to do but there’s just too much debt, personal and national, tied up in the economy. What they are trying to do is just to raise the rates high enough to see if they can bring the inflation down slowly over time while not fucking up they whole economy.

ACiD_80 t1_jadfu5a wrote

My bet is they gonna raise

SateliteDicPic t1_jadfzfr wrote

WSB 2022: “Transitory? Powel’s job should be transitory. Of course we have inflation m1 went up 8464538265% in one hour!”

WSB 2023 YTD: “Inflation is dead, we have a no-landing scenario here.” “Soft-landing confirmed (various clownass Uber bullish noises) TSLA to 500 by EOY.

The Fed and every reasonable economist out there knows damn well only a recession gets us where we need to be. But then again maybe we can just have an 80 year bull market and the labor market won’t crack for the first time in recorded human history right?

[deleted] t1_jadjup3 wrote

[removed]

Keraxs t1_jadmxgr wrote

seems like it never does and never will (until rates fall, then briefly)

OmNamahShivaya t1_jadu45y wrote

I don’t understand what any of this means so I’m just gonna keep gambling on high risk swing trades and speculative long holds and hope I win the lottery basically.

the_bondvillian t1_jaeh8l7 wrote

suprised anyone on here knows what taylor rule is

Javier-AML t1_jaelf3o wrote

True crisis are credit crisis.

When you give people money and they don't pay back, that's when shit hits the fan.

scothu t1_jaemo1n wrote

Should've known all the regards here don't know what the Taylor rate is and should've added that information somewhere in the post. Taylor ain't the "dude" behind Wendy's either

FifaPointsMan t1_jaeohq8 wrote

So it will go to 6%

chodmode2 t1_jaeqgn4 wrote

Taylor happens to be my wife's boyfriends name

[deleted] t1_jaer8le wrote

[removed]

[deleted] t1_jaew0lz wrote

Who tf is Taylor

Javier-AML t1_jaew5wp wrote

I had to go to Wikipedia to learn what the fuck the Taylor Rule was.

You fucking nerd.

PS: JPow is a pussy for not raising rates earlier and higher.

CapableSheepherder98 t1_jaf3x3n wrote

Oh graphs more graphs

on_Jah_Jahmen t1_jaf50yw wrote

Lol

MrStealYoBeef t1_jacskj3 wrote

You wanna put some lines on that graph and tell us that Taylor Swift is going to the moon as well?