Submitted by NoMoreLandBro t3_z8ignq in wallstreetbets

Comments

NoMoreLandBro OP t1_iybslt7 wrote

Yeah I’m kind of buy and hold. But not like 30 years; more like, oh look, gold miners are cheap, let me buy $100k, and now I have a $30k gain on them over a few months but I don’t want to sell, and incur short term cap gains in 2022. And I think they could still double from here so I’m holding them for the long-term cap gains tax to kick in.

I do more macro based analysis and hold until the macro environment changes. I bought $100k of infrastructure stocks in late 2020 anticipating a congressional bailout around spending. I sat in them for 4 months doing nothing while tech tripled. And then tech crashed and my play paid off, but I sold, wasn’t the time to hold infrastructure stocks anymore.

I think WSBers who get older will like my strategy. I’m not buy an index fund and sit for 30 years but I’m not buying 0DTE options either. I do something in the middle.

conviper30 t1_iyciicu wrote

So what in particular do you look at for macro analysis? Sorry I'm a crayon eater so you may need to explain it to a not so smart person.

NoMoreLandBro OP t1_iyd0lft wrote

It’s not really codifiable or objective. I look at what’s happening in the world and think about where money will flow.

In early 2020 I was in line at the post office, wearing a mask when that nonsense started, and an old man had ridden his bicycle here. He said the gyms being closed made it hard to work out so he was biking more. I immediately thought “peloton will soar on these lockdowns” because I KNEW lockdowns would last 18 to 24 months.

But I didn’t buy any, the stock seemed expensive. Oops.

By late 2020 I saw the ‘vid was entrenched and knew it would be a massive recession. And the government would propose infrastructure spending. So I went heavy into infrastructure stocks while everyone else was piling into tech.

Late 2021 I said war was going to be a way for the politicians to divert inflation so I went into defense contractors.

Mid-2022 I saw green energy policies in Europe complained with anti-Putin pro-Ukraine rhetoric would mean high energy costs there and shortages. So I sold the few European stocks I had, and I bought into uranium since nuclear is the only way out for them.

Nord pipeline blew up and I knew the oil had to be transported in tankers so I bought tankers.

I look to see what’s happening in the world. And IF the stocks are cheap enough to buy, I’ll buy. I missed on peloton because it looked expensive. I missed on Zoom because I work in IT and have known for years Zoom is trash spyware and had no idea it would go so fucking high.

If you study history and psychology you can see where the world is going. And try to front run investments. If you only invest when the macro picture looks possible and the stocks are value, then even if the macro is wrong, you bought into value so it wasn’t that bad.

Value being something that’s under 12x earnings (PE) versus growth that’s like Tesla that was 900 PE last year. I don’t like growth stocks because if you’re wrong, you’re spectacularly wrong. Look at early to mid 2022 what happened to Ark innovation stocks. But if wrong on deep value stocks, they’re still deep value.

SoulMute t1_iyd36d0 wrote

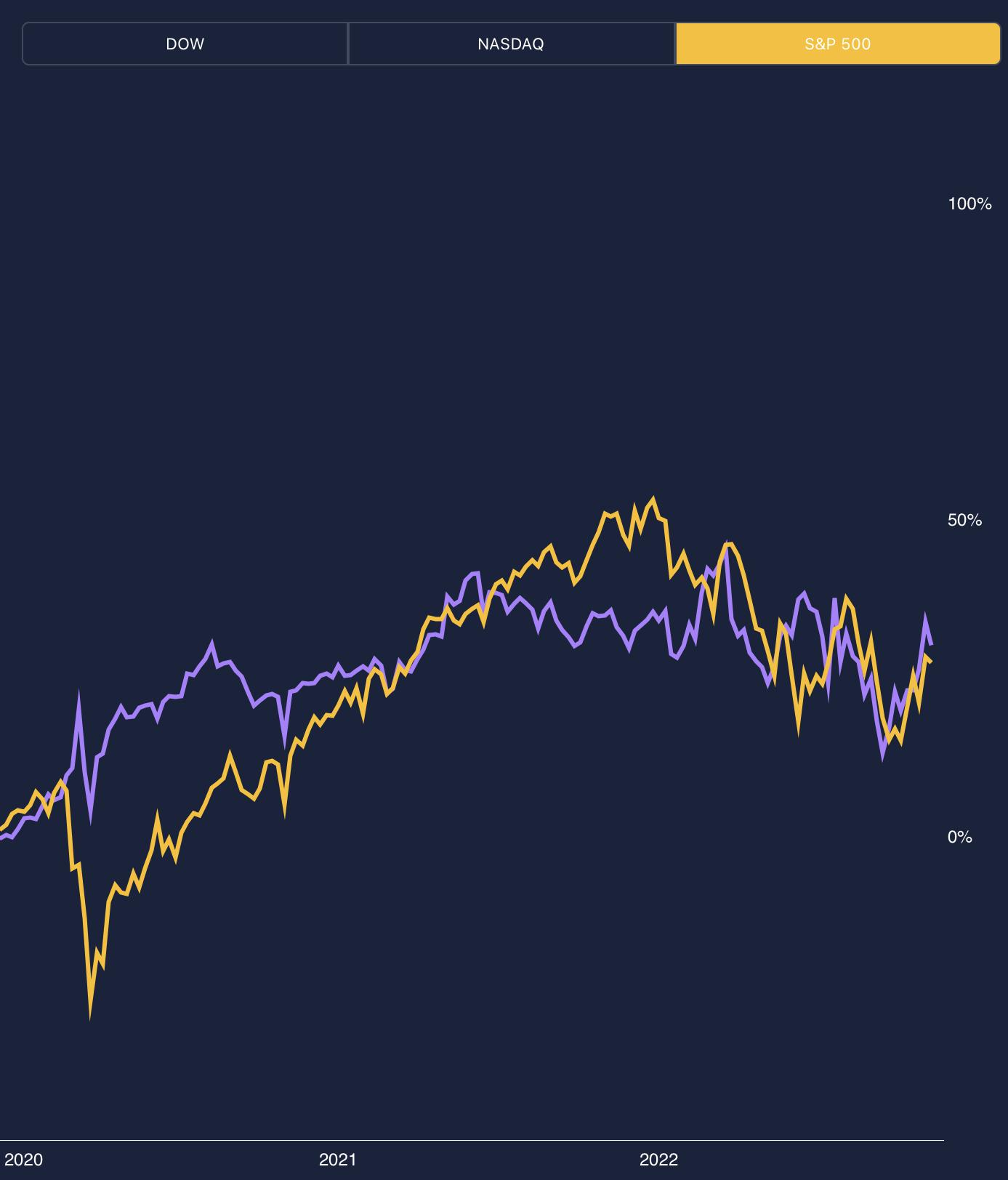

All of this sage wisdom to match the performance of the S&P tho.

NoMoreLandBro OP t1_iyd3myx wrote

Exactly. Kind of a waste of time. The reason I dislike the SP500 is it gets growth stock weighted with crap I dislike like Facebook and Tesla. In 2020, something like 40% of the SP500 was in Apple, Google, Amazon, Facebook, Microsoft, and Tesla.

1nd3x t1_iyejnvj wrote

>Exactly. Kind of a waste of time.

Not for me it wasnt...I'd tip you but I'm an asshole...lol

Seriously though, thanks for taking the time to write this stuff out. I've been going through some of your comments as I find them here and you've done some things I was considering and didnt, and I did some things you were considering and didnt...kinda allows me to learn from the things I decided not to, and see what make others consider not doing it (like...was I just lucky on a coinflip I thought was in the bag based on missing some info...info you maybe had that caused you to think "nah, not for me")

​

You mentioned Uranium, I would offer up Helium as another commodity now that the US government is done price suppressing it.

If you want some symbol tips, or want to connect and chat about investments in general send me a PM, I'm always interested in expanding my network of trusted individuals(just you, I'm ignoring other people messaging me requests)

NoMoreLandBro OP t1_iyek53o wrote

How do I invest in helium? I’ve heard about this shortage for years. It’s used in MRI machines.

Ok-Government-846 t1_iydaw9s wrote

@nomorelandbro. i realize you think this is fun and you think youre smart...lol...but if u had this much time on your hands youd buy the sp 500 or most of it (you mention you dont like certain ones in comments below) Individually -key word here- and then sell the losers at year end for tax harvesting. bam you just beat yourself the sp 500..

Pilsner12345 t1_iyeilsf wrote

It's still wisdom you can't loose

SoulMute t1_iyerxfd wrote

You’re loose.

Pilsner12345 t1_iyf2vl8 wrote

I'll give you this one

emptyzon t1_iye90ea wrote

“If you’re wrong, you’re spectacularly wrong.”

Seems like that’s the theme of this subreddit. A chance at chasing spectacular gains for spectacular losses.

Good on you for such tight risk management. That’s what separates you from the rest and preserving your fairly sizable capital.

NoMoreLandBro OP t1_iyeih22 wrote

Thanks! I received a compliment from a friend that it’s impressive even though I basically matched the index, because my volatility was so much lower.

Honestly also I hold a ton of cash. So basically, the non-cash positions I held have massively beat the index, and the cash acted as a drag. But, like you say, risk management, I like having the cash, it leads to lower volatility and gives me more options.

[deleted] t1_iyd2a3c wrote

[removed]

LOLeverage t1_iydk0dj wrote

Teddy? Is that you? Big fan.

[deleted] t1_iyctyx5 wrote

[removed]

conviper30 t1_iycu4re wrote

Huh?

0xf3e t1_iycxlgl wrote

FED interest rates.

vanpenzlovera t1_iycpme8 wrote

so swing trading?

Beasting-25-8 t1_iycirjg wrote

Sounds like too much effort for my old ass. Good for you though.

I'm just going to invest every two months into whatever dividend stock is cheapest. Eventually I'll have a diversified portfolio then I can move stuff around as individual stocks get overpriced.

thecasio22 t1_iydtecw wrote

Ah yes, the strategy of managing multiple $100k positions

NoMoreLandBro OP t1_iydu95f wrote

ElGeeQue t1_iydn0ii wrote

Jesus I can’t wait to be rich enough to give a flying fuck about taxes

Freebirdthefreebird t1_iyelcyl wrote

Sounds like r/investing to me :)

OrdinarySignature823 t1_iycf04q wrote

Sounds very rules based, very repeatable and very real. You will outperform for sure.

NoMoreLandBro OP t1_iybrq6h wrote

If I just bought an index fund, I could have saved enough time over the last three years to learn a foreign language or more likely, to masturbate thousands of more times.

For those wondering I sold most of my stocks in early 2020 and was heavy into gold and long term treasury bonds so I did great during the march 2020 crash. And I started buying back into stocks, but not much because I thought things would go much lower. So the SP500 shot up while I stayed flat. By early 2022 I sold off all my bonds and moved heavily into commodity producers which seems to have kind of tied the SP500 for 2022 over the course of the year.

Made some shit plays like lost $30k in Redfin and Zillow, but made it up by shorting Tesla, so the yolo plays were not too productive on net. Made maybe $20k profit on yolo shit. Which really just helped me compensate for the lack of tech stocks in my portfolio since I thought they were in a bubble for 3 years and avoided them.

Oh and I had/have $40k of Russian equities that vaporized to near zero. I expect they’ll be unfrozen eventually and turn into $150k+ overnight.

TastyToad t1_iycjlzg wrote

Yeah but masturbation is just a short term pleasure. That gambling thrill you get from watching line go up (or down) on the other hand ...

Melodic_Risk_5632 t1_iycyl7b wrote

Putin will 4 sure masturbate on your last line here. The fella is so desperate nowadayz.

[deleted] t1_iydni7y wrote

[removed]

dallasgroper t1_iybub2a wrote

And you're easily beating 99% of the geniuses on here

aligators t1_iyc0d90 wrote

you're saying my tesla calls arent going to make me 20k next month

Fwpa t1_iycnj5i wrote

They probably will

RevolutionaryShine73 t1_iycplwf wrote

What about the other 4%?

mazarax t1_iybvlpw wrote

In hindsight, the winning move: In march 2020, sell everything, and move it all into an index fund.

NoMoreLandBro OP t1_iybx8t0 wrote

Hindsight of 2020 is 20/20

notahoppybeerfan t1_iycm3w2 wrote

In the fall of 2019 a buddy and I talked about how we were playing “bubble chicken”. I had virtually no liquidity. Got out 100% in Feb of 2020 (yay). Amazing luck!

Only to watch inflation ravage me for two+ years.

We also bought a house in 2018 and refinanced in 2021 but now feel pretty stuck here.

Even the thinnest slice of ham has two sides.

jamespgleason181818 t1_iycqe2h wrote

How do you like owning a home with your "buddy" ;)

notahoppybeerfan t1_iyctors wrote

Well played. :)

gadzsika t1_iycgazu wrote

And how much did you pay as fees for the thousands of trades?

wiggypiggyziggyzaggy t1_iybukjc wrote

Interesting that you’ve traded well inside both the peak and trough.

Do you think that reflects your intention? Any changes to your approach going forward based on that?

NoMoreLandBro OP t1_iybvq7e wrote

Reducing volatility is a good thing. I’d rather have a tighter spread up and down than wild swings all else equal if the end balance is the same.

Yes on approach changes. Historically, I’d have an idea and not go deep enough. example, in November 2021, I thought “the main way out of inflation is war“ so let me invest in defense contractors. I proceeded to put like 5% of my portfolio into them. Made like a 30% gain in a few months when ukraine kicked off. But barely a dent to overall portfolio.

Did the same with infrastructure stocks. Only put like 10% of my portfolio in it. And those positions 2x to 3x over a year.

So when I saw gold miners were cheap a few months ago, I put 25% of my portfolio into them. And did gradually pare some gains in the way up. Still around 15% of my portfolio now.

So my change in approach is to go deeper into my macro plays.

bruteforcealwayswins t1_iycnk8r wrote

Ok I am very regarded. How is war a way out of inflation?

NoMoreLandBro OP t1_iycy7qn wrote

It distracts the populace and gives them a fall guy. Justifies increases money printing/spending by government. It doesn’t actually fix the inflation, it fixes the perception of inflation.

ChuckNorrisSleepOver t1_iyctpg4 wrote

Blow shit up = need to replace blown up shit

aligators t1_iyc08c3 wrote

you know what they say about gambling... the house always wins.

DidNotRedditMan t1_iyc0knq wrote

Still better than 99.9% of active fund managers who dare asking a fee to finance their lambo.

LineArky t1_iybz7hf wrote

Did you selflearn trading with the net or you have background in that field ? Imo your experience seem valuable to me i would like to know more

WSBaboon t1_iybs3vp wrote

try dipping the toesies in a bit of risk

NoMoreLandBro OP t1_iybsx0q wrote

Fuck it, I’m going to put it all on 0DTEs tomorrow! j/k

DrSeuss1020 t1_iycc914 wrote

What are you holding now and anticipate being good medium term holds?

NoMoreLandBro OP t1_iyczkbc wrote

PBR, VALE, ABEV are great value stocks with good dividends that will outperform if not nationalized By Brazil’s new president. Position size appropriately that if they drop to zero you‘ll be able to stomach the loss. PBR is trading at 2x earnings.

I think there’s rules against tickers of sub $1B companies but there’s only two publicly traded firearms companies in the US, they are market cap around 700M. They’ve been hit hard in the last few months. I loaded up on more.

WBA Walgreens looks cheap And nice diversifier from my otherwise commodity producers.

I’m keeping an eye on Kohls KSS because it looks cheap but has run up a bunch lately so I’d like to be a pull back. It may not happen and I may miss it but I am okay missing stuff. I want to buy $1 for to cents, rather than buy $1 for $2 and hope it goes to $3.

From a macro level, shoppers will be forced to downgrade. Target shoppers go to Walmart. And I think Kohls is a lower tier kind of place in the middle class realm. I can see new shoppers downgrading from something better down to kohls. Also there’s the bullwhip effect and I think lots of apparel and home goods places are overstocked. So they might offload stuff to kohls cheaper than usual.

I really like gold miners like GDXJ but it’s run up 30% in recent weeks so it’s tough to say it’s as good of a deal as when I got in, but I think 2x or 3x over a year is possible. If the fed pivots, GDXJ could soar. Gold is at 1750 now. It was over $2000 in early 2020 before we got 30% debasement of the dollar supply. It *should* be $3,000 an ounce now. Gold miners are a leveraged play in that if gold doubles, then miners might 5x or 10x. But it works both ways if gold goes down.

Miners use diesel as input cost so being long oil stocks is a good internal hedge.

Speaking of oil. I loaded up on tanker stocks when the pipeline magically exploded and they’re up 40% in a couple months. FRO is my fav but it’s run up a bit so Id wait to see if it drops down back to 10 before entering.

DVA Davita dialysis company. Buffet owns 40%. It crashed last month on bad earnings due. Everytime that happens, buffet buys more. I loaded up. Get in around the 70 mark and hold for 6 months, will be at 80+ which will be like 20% annualized returns. the stock has a “buffet put” where it can’t fall too low or he will buy more.

DrSeuss1020 t1_iydmbuh wrote

Thank you! These are all very insightful and well thought out thesis for each position. I appreciate you taking the time to type it out. Following you in case you post more! Great info

dingleberry-38 t1_iycekb7 wrote

Best question I have seen here yet

Jac3238 t1_iycfzt0 wrote

I call this ‘The Bogleheadification of a Regard’

InsidersBets t1_iycs5uu wrote

Think of all that lost time. Precisely why I just buy an index that tracks the S&P 500 and call it a day.

titleywinker t1_iybuyys wrote

Any silly taxable gains along the way? Buy and hold could still have beaten you

NoMoreLandBro OP t1_iybvw8u wrote

Nope I managed it with tax loss harvesting. Had like $30k of carry forward losses in 2020. used them in 2021. And now this year I have like $30k of taxable gains. But that’s Tesla shorts that I had to close out this year anyway. So not really a way to short Tesla and avoid short term gains,

okokibuynok t1_iyd02qy wrote

Yeah..a good example on why trying to time the market doesn't work

NoMoreLandBro OP t1_iyd1avd wrote

On the bright side I dramatically reduced my volatility. I didn’t post it but if you look at nasdaq versus my portfolio, they also ended the same but nasdaqs delta to my performance was even higher, it shot up rapidly and then crashed down. low volatility is preferred since if I need to draw down the portfolio at some point there is less risk of drawing down from a crash/bottom.

okokibuynok t1_iyd3xas wrote

That's true, your drop in 2020 seems a lot more palatable than the drop from the market.

NoMoreLandBro OP t1_iyd4w73 wrote

If I recall correctly. I was around 1/3 cash, 1/3 gold, 1/3 long term treasuries, leading into the march 2020. I had sold all of my stocks in 2019, I thought they were bubbly. I missed a run up but I also missed the crash.

MrULTRALONG t1_iyd1thz wrote

Time spent for nothing

NoMoreLandBro OP t1_iyd3q57 wrote

Not nothing, this post is at 286 karma and trending up!

llllllllhhhhhhhhh t1_iydazhj wrote

Sometimes it’s more about the karma and less about the money

diamond__hands t1_iyehfq9 wrote

dude you're gonna beat qqq within a few hours!

lVloogie t1_iyed0xh wrote

OP very likely learned way more with this approach.

jpwhat t1_iyd2atu wrote

And yet we’ll learn nothing from this….

NoMoreLandBro OP t1_iyd35j9 wrote

The wsb way

Adorable-Poet-213 t1_iyd3828 wrote

Averaged buy guys for the motherfucking win. Really appreciate you sharing, it gets very tempting to think I know more than the market and professionals. This is very helpful.

Unless are part of an institution with reliable alpha, buy equities as a young person and retirement products as an older one. Zero stress, zero clicks per month. All auto. Buy a bond here or there when there’s an attractive yield if you really wanna feel like a genius.

Your dipshit friend from college posting his wins is lying. Never forget.

NoMoreLandBro OP t1_iyd3g39 wrote

What would really improve my gains is if I can marry a speaker of the House of Representatives.

Adorable-Poet-213 t1_iyd9wee wrote

Im doing ok performing “services” for her husband. He asked me to bring a hammer next time tho, seems a little odd.

NoMoreLandBro OP t1_iyda5ov wrote

A hammer… services… hmm… there might be a clue in here but… I. Just. Don’t. See. It.

jchenn14 t1_iyd492p wrote

What a waste. Give it to me ill double it for you.

NoMoreLandBro OP t1_iyd4yqs wrote

UnknownFishBall t1_iyd8t26 wrote

You didn't really since covid

Acceptable_Answer570 t1_iyd9lvj wrote

Steps to making money:

Step 1: already have a shit load of money.

szybenik555 t1_iydbdtv wrote

So stop and use this time to gain more cash to invest or just relax in free time

TantalusMusings t1_iydd9u7 wrote

This is why broad market index funds are the way to go for almost everyone.

jaylenz t1_iydhqtm wrote

Sounds like you do all the work and stress while people who just buy once a month and not care are performing just as well as you, plus their life expectancy hasn’t shortened from stress

computery_stuff t1_iydtm7g wrote

now let's see your broker's portfolio account with all that juicy commission

NoMoreLandBro OP t1_iydvm12 wrote

rockybullwinkle43 t1_iyfbreh wrote

1 percenter of WSB here. Gtfo

NoMoreLandBro OP t1_iyfbvoy wrote

VisualMod t1_iybrms2 wrote

| User Report | |||

|---|---|---|---|

| Total Submissions | 0 | First Seen In WSB | 7 months ago |

| Total Comments | 260 | Previous Best DD | |

| Account Age | 8 months | [^scan ^comment ](https://www.reddit.com/message/compose/?to=VisualMod&subject=scan_comment&message=Replace%20this%20text%20with%20a%20comment%20ID%20(which%20looks%20like%20h26cq3k)%20to%20have%20the%20bot%20scan%20your%20comment%20and%20correct%20your%20first%20seen%20date.) | [^scan ^submission ](https://www.reddit.com/message/compose/?to=VisualMod&subject=scan_submission&message=Replace%20this%20text%20with%20a%20submission%20ID%20(which%20looks%20like%20h26cq3k)%20to%20have%20the%20bot%20scan%20your%20submission%20and%20correct%20your%20first%20seen%20date.) |

| Vote Spam | Click to Vote | Vote Approve | Click to Vote |

^^Discord ^^BanBets ^^VoteBot ^^FAQ ^^Leaderboard ^^- ^^Keep_VM_Alive

[deleted] t1_iydqms3 wrote

[deleted]

[deleted] t1_iybvh3e wrote

[removed]

Algarde86 t1_iybwf5l wrote

This is why I don't waste my time trading.

NoMoreLandBro OP t1_iybx7q6 wrote

what do you spend your time doing instead? Posting on WSB about how much time you save by not trading?

Dbg846003 t1_iybxsnd wrote

Here4ThaMunz t1_iyd09yt wrote

SpakysAlt t1_iyc1lov wrote

Taxable account?

[deleted] t1_iyc93tr wrote

[removed]

jbeck525 t1_iychqbk wrote

Sell csps on BOIL, youll make bank!

[deleted] t1_iycijpw wrote

[removed]

AdJunior8357 t1_iyckjw7 wrote

Teddy Baldassarre is that you?

[deleted] t1_iycpu81 wrote

[removed]

flaming_pope t1_iycr0kg wrote

You’re a momentum trader.

Also looks like we’re about to crash. All the momentum traders like this one are long.

NoMoreLandBro OP t1_iycy1cc wrote

I am long commodity producers, gold miners, and some deep value stocks. I have quite a bit of shorts. Short Tesla, QQQ, Amazon, Meta, SEDG, and a few home builders.

Acceptable_Answer570 t1_iydaka3 wrote

You actually short stocks, or are into puts?

NoMoreLandBro OP t1_iydbyd2 wrote

I short stocks, I buy puts, I sell naked calls. If the IV is high, I might short rather than buy puts because I don’t want to eat the IV.

If the IV is super high I might sell deep OTM naked calls, to harvest the premium. I might also buy an even deeper OTM call to hedge my potential downside risk.

Currently selling naked calls on SEDG. Shorting QQQ and home builders. Puts on Amazon and Facebook and Tesla.

I don’t like puts on home builders because they are thinly traded and the spread is too high. So I just short them.

Acceptable_Answer570 t1_iyde5cd wrote

I’m really new to investing so a lot of those terms are still wild to me 😅.

Why home builders?

And why short QQQ, when everyone is expecting a Christmas rally? Are you in it long, for the 2023 slippery slope?

NoMoreLandBro OP t1_iydqc2b wrote

Position sizing. My taxable account is where I do most of the shorting and I’m 70k long gold miners, 15k long gun stocks, 15k long divita.

15k short QQQ

20k short home builders

25k long dated puts on Tesla, Facebook, and amazon

If we have a Christmas rally, my tech shorts will be crushed but my long positions should outperform enough to compensate. And even though the puts will be further OTM, the IV will spike so they wont drop as much.

Homebuilder shorts because r/REBubble and I think Papa J will will be more hawkish the market expects and mortgages will be 10%+ next year as they raise rates and sell MBS off their balance sheet or simply dont roll maturing MBS. Builders are making houses they wont be able to sell because when built, theyll be worth less than the materials, and also rates will be much higher and buyers will back off.

OR papa J pivots, my shorts get crushed, and my 400k+ retirement account with 80% commodity producers soars. I’ll get tax deductions for my losses in the shorts and my retirement accounts grows tax-free and/or tax-deferred.

Acceptable_Answer570 t1_iydrie8 wrote

Jesus, I wish I had this amount of brains, I guess it comes with years of experience!

Did it all come from savings, or over-time gains?

NoMoreLandBro OP t1_iydty03 wrote

Step 1 is get a 200k/year consulting job.

Step 2 is don’t lose it on crypto and 0DTE options

Step 3 is become interested in macro economics, spend a decade reading books and in your free time watch YouTube videos of people discussing current macro trends.

Step 4 apply critical thinking

Example: Peter Schiff recently said Walmart shoppers are putting more stuff on credit cards. From point of sale register data.

And he interpreted that to mean Walmart shoppers are going into debt to buy food.

I interpret it differently. Walmart has said they are stealing market share from Target as people downgrade their lifestyle. Well, target customers have more rewards credit cards than Walmart shoppers. So if Walmart experiences a transition where they get 20% more customers from Target, I’d expect 20% more credit card to debit card sales. Since the poor legacy Walmart customers are the ones with fucked credit who must use debit cards and not earn cash back rewards.

I can’t do anything with this piece of data, just mention it to use critical thinking and interpret things differently than the experts.

Acceptable_Answer570 t1_iydwcd1 wrote

My guy, you’re way too smart for us, simple regards!

Haunting_Change1793 t1_iycsgoc wrote

Enjoy your cash!

Imaneedasandwich t1_iyctstx wrote

Given the sub you're posting this on I'm shocked honestly.

Omega_112 t1_iycuwu9 wrote

Rigged

No-Reflection-7705 t1_iycwasx wrote

A win is a win

Explains_Wrong t1_iycy5a6 wrote

Hmm. Kinda makes you think. Maybe I should just buy some index and chill? Nah, not enough dopamine involved there.

[deleted] t1_iyd2nhh wrote

[deleted]

[deleted] t1_iyd2tt9 wrote

[deleted]

NoMoreLandBro OP t1_iyd31v2 wrote

Taxes were fine, most of my trading was in retirement accounts and my taxable accounts I use tax loss harvesting.

It’s a hobby and fun for me, to read news and do macro analysis. Also, now that I’m more confident in my analysis, I can go heavier into sectors I see greatest potential in. Had I position sized higher on my plays, I’d be beating the market by quite a bit.

In a way, it’s saving me money that I might have to spend on a hobby.

International-Two173 t1_iyd6cle wrote

You matched 3 year returns but, had lower variance. That's pretty rare to see.

TwentyCharactersShor t1_iyd8kgo wrote

But think of the fun you've had. You can't put a price on that.

Kamikaze_Cash t1_iyddce4 wrote

After taxes, you’re probably underperforming the S&P like everyone else.

JordanBeefort t1_iyddh6v wrote

YOU STILL BEATIN IT BOY DON'T LET EM FORGET IT

trex4700 t1_iydim0t wrote

Good shit. 3 years and beating the market is a win. Year 5 is when I started beating the market rather consistently. The bear market years I did much better. I lean more on weekly cheaper OTM puts during down markets and make more. Try to time LEAP buying for slower gains at or just above market in bulk markets. It’s changed my life man. Keep it up!

motherlovebone420 t1_iydkeuy wrote

Buy some straddles

motherlodepc t1_iydm6os wrote

Barely beating the S&P today, and by the looks of your chart, you were down ~20% to it 1 year ago?

sunshine20005 t1_iydv9pe wrote

Were you getting dividends? If not you're behind :(

NoMoreLandBro OP t1_iydviap wrote

Yeah the dividends are factored into both my returns and the SP500 returns.

Alec_NonServiam t1_iydw5d2 wrote

Oh hey, it's funny rebubble meme man!

Shit man, your YTD looks better than mine. You called basically the exact bottom on Covid too, GG.

Plays on FOMC week?

NoMoreLandBro OP t1_iydx0xc wrote

No specific plays, I try not to guess week to week. The longer out you are predicting a trend, the better chance of success.

If I had to guess, JPOW going to say some shit to shock the markets. I think he wants the SP500 down to 3,000.

So, I am short, see other comments in this thread for my specifics, but the shorts are not short-dated puts. My puts are for 6+ months out. So I’m wrong, I’ll just sit and hold. I wont get margin called I have 250k cash in t-bills. And only shorting around 100k.

If we get a Santa rally, I plan to sell ITM naked calls on tech stocks and buy deeper OTM Calls to hedge my downside risk. Santa rally will pump up IV and in general you want to sell options into high vol, and buy options in low vol times.

ankole_watusi t1_iydxide wrote

So, doing pretty good.

Mnshine_1 t1_iydxq6q wrote

What about watch investment Teddy? 🤔

Infamous_Sympathy_91 t1_iyeqbqh wrote

Trade 75% less.

Legitimate-Freedom77 t1_iyexmm6 wrote

Gme

TheMotherConspiracy t1_iyexn3m wrote

Are you at least collecting CC premiums on that?

NoMoreLandBro OP t1_iyez5of wrote

I got burned selling covered calls a few times and do it only rarely now. I bought some SLV this week, sold weekly ITM calls for what will be a 40% annualized return for the week. If SLV drops, I’ll want to keep it anyway and will stop selling calls until it goes back up.

TheMotherConspiracy t1_iyf1ye9 wrote

Sounds like a solid plan.

Out of curiosity, what positions did you get burned on?

NoMoreLandBro OP t1_iyf4pmn wrote

Poshmark 90% loss

Zillow 40%

Redfin 40%

Palantir - but only lost 40%, I bought in around $14

​

I felt these were good diversifiers since I didn’t have any tech stocks.

charliekunkel t1_iyf2vv8 wrote

Your broker thanks you

9tacos t1_iyf5hgt wrote

You’re not the only one

NoMoreLandBro OP t1_iyf8hhs wrote

MollyMuncher t1_iycqp4e wrote

Should have wore a mask when Covid hit…. over your eyes when logged into your brokerage account!!! ROFL… sorry bro

nailattack t1_iybs13q wrote

The fact that you’re even beating it is fucking amazing lol. Most people don’t.

Maybe it’s a good time to switch to buy and hold, spend your time doing better things