Submitted by doubledgetmoney t3_zxs85c in wallstreetbets

Comments

brawnkoh t1_j254yeh wrote

In all fairness, You can gamble in an IRA. You just have to make sure you have a Roth 401k, and a Roth IRA (don't gamble in both). lol

Whythehellnot_wecan t1_j266p4y wrote

Correct Answer. Never go full regard.

conviper30 t1_j259ump wrote

Curious, why VOO? Looking at setting and forgetting strategy next year..

PricklyyDick t1_j25h74b wrote

Slightly lower operating expenses than SPY by like .01 or something like that

conviper30 t1_j25kqf4 wrote

Hmm good to know thanks!

[deleted] t1_j24k4tp wrote

[removed]

brucekeller t1_j25b0ay wrote

Buffett didn't get rich by buying VOO. But it probably would help to get companies that have earnings and are undervalued. OP likely had their Roth in straight up memestocks bought at the top. At least they did it while the Roth was so small instead of blowing a few hundred thousand or something.

[deleted] t1_j25c4um wrote

If you think 99.99% of us can invest like Buffett, then you’re probably wrong

DvisionX t1_j2617an wrote

I have two investment accounts: 401k for retirement that I don't touch and a personal account for pretending I'm Warren buffet.

blaked_baller t1_j26hrvb wrote

Im rlly regarded so I have a 401k, roth, and an individual account where I buy n forget.

But I go crazy dumb stupid in another individual account. I have to keep this 3:1 ratio or I'd be on the streets with how my option plays have been going

Paul_Varjak t1_j27r9e1 wrote

This

cl0wn_w0rld t1_j2bcws8 wrote

i just watched the documentary on HBO about him and Ichann and I know for certain I am not as smart as either of them.

[deleted] t1_j25huq4 wrote

[deleted]

bagvwisthsjsjsjjs t1_j235nkq wrote

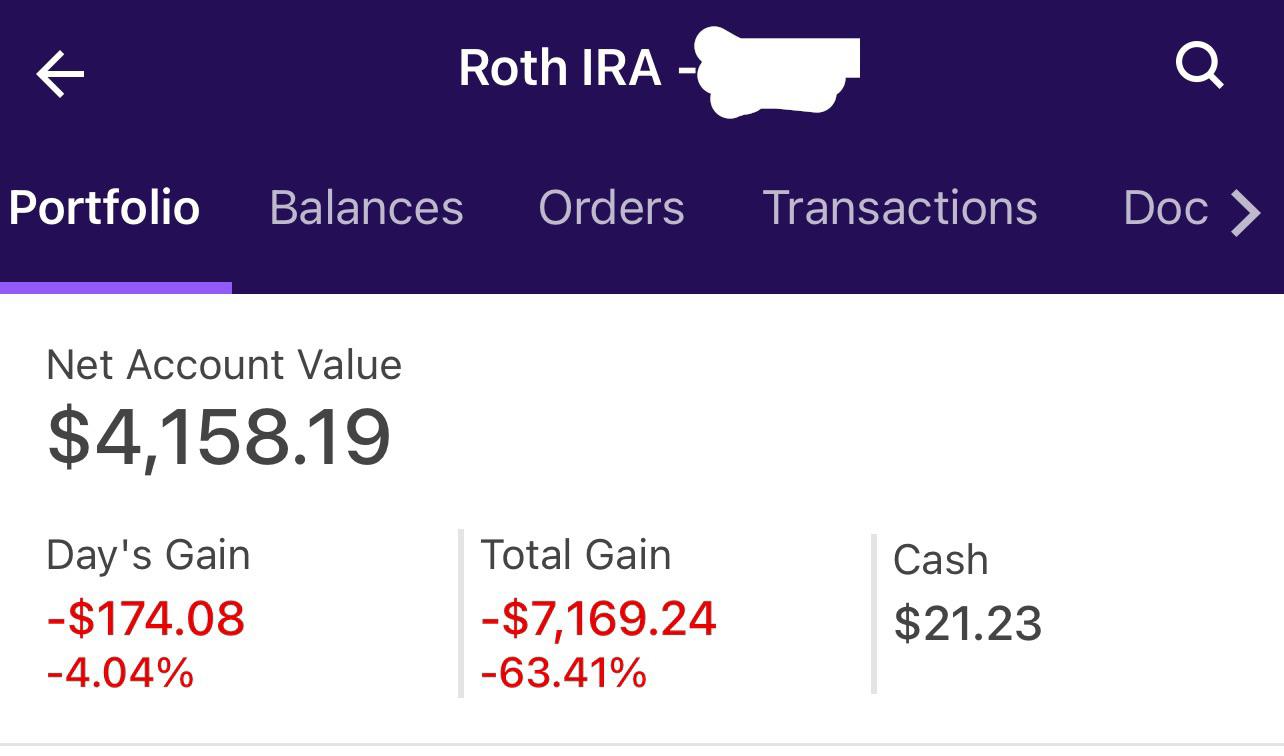

Jesus Christ dude. That’s supposed to last you until 65. You hardly lasted a year. Get your shit together and stop investing in high beta stocks.

Explosive-Space-Mod t1_j24zsgi wrote

Man invested 100% into tesla on his Roth IRA.

PeederSchmychael t1_j25einw wrote

Who knows. @ 65 could have been the best play. tax free

baudinl t1_j25kniz wrote

OP is definitely a high beta tho

ryyanorainy t1_j23coya wrote

Fuck all the hate, you came this far put the rest into LUCID and Roblox or make it back with far out put options. You got nothing to lose at this point

Apha-apha t1_j23d483 wrote

Lucid for retirement? Ru sure?😂

ryyanorainy t1_j23d852 wrote

I mean down 63% he has to do fucking anything at this point 😂

Muggrohh t1_j23jiqc wrote

Warren Buffett quote

“It is true that a very important principle in investing is you don’t have to make it back the way you lost it... in fact, it’s usually a mistake to make, try and make it back the way that you lost it.”

A good principle to remember

brawnkoh t1_j2556zk wrote

OPs better off buying Robux for fiat and hoping the value of Robux goes up.

[deleted] t1_j24kbok wrote

[removed]

Awkward-Issue-1311 t1_j23h7rn wrote

Get a job

WhiskyPapa911 t1_j23zjd1 wrote

Bro, your roth ira suppose to be your safety net. Why are you gambling with your retirement found? Stick with index funds and nothing else.

spagetzzi t1_j240x25 wrote

Lol -63% in a Roth

Kypeeeee t1_j23qggy wrote

Looks like you still have room to lose, keep going till you hit 0, I believe in you!

IVCrushingUrTendies t1_j24cc4m wrote

Idk why ppl are freaking out. 401k is don’t touch. Roth is a good way to gamble tax free. Just switch to trading SPXL SPXS, 3x bull bear ETFs. When you feel confident but a single SPY call or put like 1 week out for a couple hundred bucks and sell after a day. You’ll get it back np

[deleted] t1_j24la4p wrote

[removed]

[deleted] t1_j24nid1 wrote

[deleted]

Explosive-Space-Mod t1_j250evz wrote

> ceteris paribus

Isn't this the reason for the ROTH in the first place? Hedge against raising taxes on large amounts of money so you pay in a bunch while you're in the lower tax brackets so when you retire you don't get Uncle Sam giving you a proctology exam with his hands on your shoulders.

[deleted] t1_j251wul wrote

[deleted]

Explosive-Space-Mod t1_j2528do wrote

I'm with you on the not gambling part. It's the "All things considered the same" bit which is hardly the case when talking retirement plans.

My retirement plan is in an index fund with deposits each paycheck and if I feel like gambling I just go mess with crypto for a little bit and lose it there instead of with stocks.

[deleted] t1_j253f07 wrote

[deleted]

ChuckyMed t1_j24q422 wrote

Literally just put everything on VOO and live your life. You will outpace all the glue eaters here

Explosive-Space-Mod t1_j250m4r wrote

Some glue eaters here will have more maximum income but also, like most lottery winners, will spend or lose it all extremely quickly.

[deleted] t1_j24r7ll wrote

[removed]

cophotoguy99 t1_j26jabk wrote

Add more money

Dothemath2 t1_j23eyiy wrote

I would wheel INTC. Collect dividend and cc premium tax free. Safe investment for years. Low PE, big expansion coming, already severely beaten down.

[deleted] t1_j23rl2b wrote

Close the account and save the money in home.

ValenciaTrading t1_j2500s6 wrote

Can you define a Roth IRA stock?

[deleted] t1_j250i2p wrote

[removed]

awwfishsticks t1_j26cfzy wrote

Yeah. VTI.

doubledgetmoney OP t1_j26wysa wrote

🤙🏽

hosea_they_heysus t1_j26rne9 wrote

Depending on how old you are, buy stocks that are riskier/safer. If you're in your 20s or early 30s a loss like that is no big deal. You've got years to make it back. Pick stocks that are a wee riskier and have potential to give higher returns. As you pass your 30s tho, you want to go more towards the safer slow movers like VOO or SPY etc. Etfs with lower risk so you don't have to worry about your retirement as much and you can switch the riskier gainers into safer slow movers

doubledgetmoney OP t1_j277edf wrote

Appreciate that, man!

[deleted] t1_j2353ki wrote

[removed]

VisualMod t1_j235421 wrote

| User Report | |||

|---|---|---|---|

| Total Submissions | 0 | First Seen In WSB | 9 hours ago |

| Total Comments | 0 | Previous Best DD | |

| Account Age | 10 hours | [^scan ^comment ](https://www.reddit.com/message/compose/?to=VisualMod&subject=scan_comment&message=Replace%20this%20text%20with%20a%20comment%20ID%20(which%20looks%20like%20h26cq3k)%20to%20have%20the%20bot%20scan%20your%20comment%20and%20correct%20your%20first%20seen%20date.) | [^scan ^submission ](https://www.reddit.com/message/compose/?to=VisualMod&subject=scan_submission&message=Replace%20this%20text%20with%20a%20submission%20ID%20(which%20looks%20like%20h26cq3k)%20to%20have%20the%20bot%20scan%20your%20submission%20and%20correct%20your%20first%20seen%20date.) |

^^Discord ^^BanBets ^^VoteBot ^^FAQ ^^Leaderboard ^^- ^^Keep_VM_Alive

[deleted] t1_j23bqof wrote

[removed]

TendyChaser t1_j23h1p4 wrote

UnderQualifiedPylote t1_j24vnj6 wrote

Vti bro

[deleted] t1_j24zpli wrote

[removed]

Kirilav t1_j24wp11 wrote

Since I’m a degenerate at heart I do 70% VTI & 30% AVUV to satisfy my gambling needs.

[deleted] t1_j24zx23 wrote

[removed]

yao97ming t1_j2511rl wrote

Uninstall the app

ZenStocks t1_j251xmn wrote

How the hell did you do that? 😂 You must be young so it probably doesn't matter. My advice: don't repeat what you were doing 💀

Independent_Row_Goes t1_j257nbq wrote

Show the positions. Get some free advice

[deleted] t1_j259auk wrote

[removed]

[deleted] t1_j258jv1 wrote

[deleted]

[deleted] t1_j259e1g wrote

[removed]

Adorable-Menu5244 t1_j25e8r0 wrote

What about tsla options call

[deleted] t1_j25fnmp wrote

[removed]

PeederSchmychael t1_j25ezb9 wrote

Did you actually lose (sell)?

[deleted] t1_j25fov4 wrote

[removed]

dramarehab t1_j25vmji wrote

Pull all your money out before you lose it all LMAO

doubledgetmoney OP t1_j25wxn8 wrote

I’m thinking one stock of S&P 500? Or a lot VOO or VTI?

dramarehab t1_j25xrd1 wrote

you can’t “buy” a “share” of s&p 500

doubledgetmoney OP t1_j25y3cx wrote

Ok

doubledgetmoney OP t1_j25yyar wrote

VOO ETF it is….

its-me-reek t1_j26gfv4 wrote

Try 7figure

JuevosTiernos t1_j26nwvm wrote

Peter Thiel over here

[deleted] t1_j26urrk wrote

[removed]

[deleted] t1_j23bjke wrote

Never gamble on a Roth IRA account: buy VOO consistently and forget about it